The following is the uncorrected text for a chapter in the forthcoming Routledge International Handbook of Failure: Critical Perspectives from Sociology and other Social Sciences, edited by Adriana Mica, Mikołaj Pawlak, Anna Horolets and Paweł Kubicki, which should be published in 2022.

This chapter seeks to reframe the recent global phenomenon of financialization within the scope of the study of failure. Financialization refers to the increasing power, influence and ramification of capitalism’s speculative financial dimension, both historically and in the contemporary period. The emerging field of critical finance studies has formed around the recognition that the distinct economic, political, social and cultural aspects of financialization cannot be understood in isolation (see Mader, Mertens, and van der Zwan, eds. 2020). In this chapter I will seek to show how focusing on the question of failure can be fruitful in helping us unpack these interdisciplinary links.

The chapter advances three related discussions.

It the first part I frame financialization as it is depicted in recent scholarly literature as, simultaneously, a period, a process and a logic. This conceptual triumvirate helps us understand financialization’s economic, political, social and cultural dimensions.

In part two I draw on a range of thinkers to illustrate some forms of failure associated with financialization. First, I explore the failure to regulate finance in the lead-up to and wake of the 2008 financial crisis. Second, I note that financialization inherently depends on the failure of numerous enterprises, economies and individuals, with dramatic consequences. Finally, I propose that finance is a failed structure by which the system of capitalism seeks to “imagine” the world.

In the third part, I turn to the case study of the anglophone North Atlantic public university as a institution undergoing financialization. Drawing on ongoing research on how this financialization affects students and faculty, I suggest that financialization both induces and benefits from encouraging all or most to “feel like a failure.” I link this to the precipitous increase in mental ill health in these institutions.

I conclude by suggesting that financialization’s power may force us to challenge the way in which we frame and evaluate forms of resistance and our expectations of social movements. It might encourage a turning away from conventional measurements and assessments of movement success to explore the productivity of failure as a critical frame.

Financialization

In recent decades, capitalism’s financial sector, tasked with handling the creation and movement of speculative wealth, has often been summarized with the acronym FIRE: high Finance (eg. investment banking, private equity, etc.), Insurance and Real Estate. The term financialization signals a range of shifts that occur as the FIRE sector transforms and gains influence over areas of social, economic and political life well beyond its that sector itself. As the diversity of contributions to the 2020 Routledge International Handbook of Financialization makes clear, a broad range of scholars have recognized that an interdisciplinary approach is key to understanding financialization from economic, political, social and cultural conditions (see Mader, Mertens, and van der Zwan, eds. 2020).

On the economic level, financialization represents, at its most basic level, the growing wealth and profound power of the FIRE sector over other sectors of the capitalist economy. More generally, as Ertuk (2020) summarizes, it refers to the many ways that sector’s influence shapes, constrains, reconfigures and recalibrates non-financial sectors, firms and economic actors, large and small, such that these actors come to serve or emulate those of the financial sector.

On the political level, financialization can identify the influence of large institutional creditors, ratings agency, foreign and domestic investors and other financial actors over governments and policy-makers. As Pagliari and Young (2020) note, governments and public institutions are increasingly if variably recast in light of those pressures, as indicated by the discursive shift in public administration towards speaking of “investments” “assets” and “leverage,” as well as their importation of logics of financial austerity, accounting and auditing.

In social terms, financialization describes the way a vast range of social actors, from individuals to institutions, navigate a world framed by financial pressures and opportunities. Under financialization, I have been among the scholars who have argued that social agency is increasingly shaped by financial power and often expressed in financial terms, as for instance when questions of human shelter or education, which might have once been cast as matters of public concerns, are recast as private “investments” (Haiven 2020).

At a cultural level, financialization represents a shift of meaning-making and the formation of subjectivity whereby individuals come to model themselves and their approach to the world on the figure of the financier (see Aitken 2020; Langley 2020).

Drawing on these four layers of analysis, recent theorists of financialization have framed the phenomenon in at least three overlapping–and at times contradictory–ways: as a period, as a process and as a logic.

Financialization is often associated with the contemporary period, dating from the 1970s or 1980s. Yet as Beck and Knafo (2020) illustrate, there is a fair degree of debate over when to mark financialization’s beginning: In 1973 with Nixon’s decision to sever the US dollar from the Gold Standard? In the early 1980s with Margaret Thatcher’s “Big Bang” deregulation of financial markets in the UK and the “Volker shocks” in the US? In 1989 with the collapse of the Soviet system and the movement of China towards capitalism? Or in the “roaring 90s” when financial profits accelerated thanks to the global integration, neoliberal deregulation and computerization of markets?

Literary theorist Jameson (1997) has linked financializaton to the social and cultural processes associated with postmodernism. For more liberal critics, including noted financial journalist Foroohar (2016) or former World Bank president Stiglitz (2010), financialization names a moment when the otherwise important and functional FIRE sector becomes so enriched and powerful it threatens to undermine the rest system of capitalism of which it is a part. From a Marxist political-economic perspective, such as that advanced by Harvey (2018), and which informs this chapter, financialization is a recurring period near the end of capitalist accumulation cycles and the highest expression of that system’s inherent contradictions. It leads, inevitably, to crisis. But in spite of their differences, nearly all these commentators agree that today’s form of financialization is unprecedented, and has profound consequences.

Approaching financialization as a process focuses our attention on the rise and influence of speculative forms of wealth and their detachment from the “real economy” of the production of goods and services. As Brett Christophers and Ben Fine (2020) note, financialization has seen the FIRE sector grow to preeminence within capitalism. FIRE’s influence is such that even other non-financial capitalist firms (in sectors including manufacturing, retail, logistics or extraction) increasingly depend on the financial sector for capital and are thus beholden to its priorities (see also Maher and Aquanno 2021). As Epstein (2020) notes, this power and influence is so substantial it that it extends to a profound disciplinary and lobbying power over governments large and small, generally driving them towards neoliberal policies that empower and enable the financial sector’s growth and spread. Appadurai (2016) has shown and these economic and political shifts also lead to (and are, in turn, supported by) shifts at the level of social institutions and cultural meaning-making. Indeed, Pryke and du Gay (2007) have observed that financialization names a tendency towards the “rewiring” of all manner of global actors, public and private, large and small, to better conform to or emulate the financial sector.

Finally, financialization has also been approached as a logic: a set of self-replicating patterns that operate systemically, without particular human intent or premeditation, and with widespread consequences. Martin (2007, 2002a, 2015) has catalogued many ways FIRE’s ideologies, metaphors and measurements have been imported into realms including military affairs, education, governance, the arts and everyday life. Birch and Muniesa (2020) have explored how the logic of financialization transforms almost everything of value into assets to be leveraged in an endless game of risk management and speculative gain; everything from housing to education to the environment are increasingly reframed in terms of costs, yields, opportunities and threats. As Komporozos-Athanasiou (2021), illustrates, each social actor (be they institution or individual) is recast as a financier, fixated on juggling and counterbalancing a multitude of gambles in a fundamentally competitive and uncertain world. As I have elsewhere observed (Haiven 2014), financialization encourages this disposition and is reproduced to the extent that a wide variety of actors embrace this logic as their own and act accordingly. It is also, as Konigs (2015) argues, defined by a unique constellation of affects, emotions and drives.

These three descriptions of financialization, as period, process and logic, have been complicated on a number of fronts. Lisa Adkins (2019), Fiona Allon (2014) and Melinda Cooper (2019) have each argued that universalizing approaches towards financialization diminish the profound ways gender shapes and is shaped by the world of financial speculation, debt and credit (see also Predmore 2020). Whereas financialization is commonly and conventionally seen as emerging from an Anglo-American post-war context and gaining global hegemony, this process is far from uniform around the world (see Gilbert et al. 2022). Financialization’s manifestation in “peripheral” Europe, Asia, Latin America and Africa is not merely a matter of emulation. Bonizzi, Kaltenbrunner, and Powell (2020) and Karwowski (2020) demonstrate how financialization draws on local historical, economic and cultural qualities to express itself in profoundly different ways in different nations and economic realms. Drawing on a concept of financialization’s overarching logic, it has been tempting for scholars, including Lazzarato (2012), to suggest the arrival of a universal financialized subjecthood. True: As the debacle of the 2008 financial crisis demonstrated, financialization embraces subjects rich and poor. But, as Roy (2012) makes clear, to different extents, in different ways and with profoundly different consequences. Some, as we shall see, are framed as praiseworthy “risk-takers” while others (individuals, neighbourhoods, demographic groups or whole nations) are cast as the abject “at-risk” requiring correction, containment or control. This spectrum frequently maps on to grids of power and privilege defined by race, ethnicity, religion and other markers of social oppression and difference, as Joseph (2014), and Chakravvarty and da Silva (2012) have shown.

Financialization’s failures

Blakely (2020) has observed that these academic studies of the success of financialization can make it appear as a megalithic and unstoppable process when, in fact it is the cumulative product of thousands of small political decisions. Yet the mistaken but appealing impression that financialization is successfully orchestrated by elites can contribute to conspiracy theories, which often have anti-Semitic overtones (see Bonefeld 2019). As I have elsewhere argued (Haiven 2018), a more nuanced understanding of financialization recognizes, first, that it is a process driven not by collusion and conspiracy by elites but by the competition, conflict and contradiction germane to capitalism. Financialization’s overarching orientation and penetrative reach, described above, only emerges at the most abstract level from the dissonant swarm of financial actors (individuals, corporations, sectors, industries and layers of government) jockeying for position.

In the face of popular approaches that see the rise of the FIRE sector as an unrelenting series of nefarious successes, my effort here will be to argue that failure plays a vital role and that examining this failure can shed new light on the processes of financialization. I focus on three functions of failure: the failure to regulate finance, financialization’s reliance on failure, and finance as capital’s failed imagination of the world.

The failure of regulation

If bringing the FIRE sector’s power to heel was their intent, capitalist nations’ response to the Global Financial Crisis of 2008 failed, epically. Economics professor and former Greek finance minister Varoufakis (2011) illustrates the ways in which, following that crisis, the transnational political potential to regulate financial markets and their growing power was either stymied or squandered. Since that time financialization has accelerated. This failure is partly due, as Soederberg (2014) illustrates, to the persistent dependency of almost all nation states (save those who export considerable amounts of oil) on access to credit, debt and foreign direct investment, making them wary of pursuing financial regulation that might upset potential creditors or intermediary institutions like credit-rating agencies. Harvey (2007) argues that is compounded by the ideological alignment of neoliberal governments with financial firms, who share the presumption that rising financial fortunes will lead to universally beneficial economic growth, and that regulation of the sector will imperil national competitiveness. As Epstein (2020) suggests, this optimism has at least something to do with the fact that, around the world, many senior politicians tasked with overseeing and regulating FIRE are former employees of the sector.

But concern over the failure of governments to significantly regulate financial markets in the wake of the 2008 financial crisis can be misleading. The misplaced optimism that regulation alone might prevent the catastrophic failure of financial markets erases a number of important points.

In the first place, focusing on the failure of regulation of the financial sector mystifies the decades of democratic failures that led up to that moment (see Nölke 2020). In the wake of the fall of the Berlin Wall and the dismantling of the Soviet-aligned socialist bloc in Central and Eastern Europe, and with the transition of China towards a form of what many consider a kind of hybrid state-managed capitalism, the global triumph of the market economy was declared to be the “end of history.” Fukuyama (1992) and other leading establishment intellectuals and politicians around the world were, in the 90s and 00s, zealous in celebrating neoliberal policies based on the idea that global competition on ever freer markets would produce a rising “economic tide to lift all boats.” Yet as Blyth (2013) notes, this neoliberal agenda, which was based on demands for great global financial and economic integration, deregulation of capital relative to social and environmental policym and the privatization of hitherto state-run aspects of the economy produced, over these two decades, a cascade of seemingly isolated catastrophes the world over.

From environmental disasters created by footloose extractive and manufacturing industries (see Gago and Mezzadra 2018) to “crises of care” stemming from the privatization of health and social services (see Fraser 2016) to the forced displacement of millions due to deindustrialization or the evaporation of economic opportunities, the neoliberal project can and should be seen as a catastrophic failure in terms of its promise to produce wealth, happiness and human thriving. It represents a monumental failure of capitalist democracy itself. In spite of efforts by commentators like Pinker (2011) to paint the neoliberalism and the end of history in rosy hues, the reality for many is, as indicated by Bello (2013) and Hong (2006), catastrophe one disproportionately born on the shoulders of those hyper-exploited under previous formations of capitalism, notably those in the Global South, racialized people and women.

In this period we have, for instance, observed the profound failure of international bodies to do anything nearly substantial enough to significantly halt the emission of greenhouse gasses, even though there is a well-publicized scientific near-consensus on their catastrophic potential and exponential patterns (see Klein 2014). Largely, the failure to act is, as Mann and Wainwright (2020) make clear, based on the fear of each nation (particularly the large and influential ones) that to do so might jeopardize their competitiveness in a global field. The now largely deregulated flow of global financial wealth makes it terrifyingly easy for multinational corporations to relocate capital, jobs and investment to the most amenable and profitable jurisdiction. In this sense, the failure to address global climate change is in no small part due to financialization.

In sum, focusing narrowly on the failure of financial regulation by this or that national or supranational body, and on the continued risk of catastrophic market failure such as was seen in 2008, occludes the deeper, more pervasive forms of democratic and political failures financialization both depends on and help to perpetuate.

Creative destruction and the necessity of failure

The political, economic and social shift towards financialization has both benefited from and helped to foster what Ehrenreich (2009) characterizes as a cultural idiom of relentless competitive optimism. This, as Harvey (2007) notes, is built on the idea that ever-freer markets will afford those with talent, perseverance and enthusiasm a field of endless opportunities where success can be expected. And yet what this optimism disguises is that, within a financialized system, the vast majority of ventures and individuals must necessarily fail.

Anthropologists of FIRE like Ho (2009) and Zaloom (2006) have shown that, in the firms that dominate the commanding heights of the sector, managers and investors sustain an institutional culture that does not accept the failure of their employees. Financial losses, or even failure to improve quarterly gains, can result in ignominious termination of employment and even public shaming. Yet, of course, on the level of the firm as a whole, failure is inevitable and not catastrophic. The contemporary financial sector operates on the principle and using the arcane mathematical modeling of portfolios: Successes and failures are carefully counterbalanced so as to ensure against catastrophes. This, generally speaking, allows powerful firms to come out ahead (see Ascher 2016).

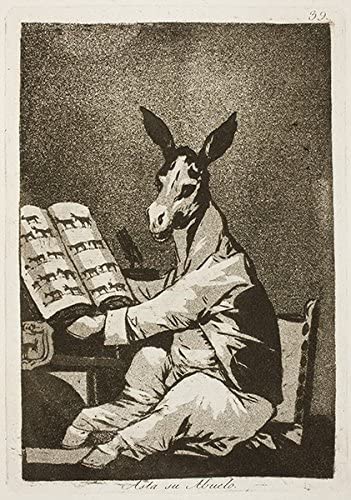

While many in the financial sector would privately (and some, publicly) agree with critics that its role on the larger economy is largely parasitic and speculative, the majority tend to espouse the idea that the sector’s role is to produce beneficial failure throughout the economy. As Lapavitsas (2013) explains, the reliance of non-FIRE firms on the financial sector drives them to ever higher benchmarks of competitive productivity, efficiency and innovation, even if these come at the expense of the firm’s fiscal sustainability, long-term competitiveness. Worker, community or environmental concerns are at best a distant afterthought. Large pools of money held by investment banks, hedge funds, private equity and asset management firms are applied to financing innovative startups and proactive companies, generating new technology, commodities and tools, but often only with an eye to attracting investors, not producing anything of substantive material value for society at large. Within this ideological framework, financiers frequently see themselves as what I have termed avenging angels of creative destruction (Haiven 2014): ethereal, superhuman messengers and servants of the inherently perfect and life-giving (if at times violent) market. Within this worldview, the often catastrophic failure of many firms that fail to compete is framed as providential, even though it might lead to economic chaos for workers, small investors and whole regions.

The failures of such a cutthroat world are unevenly distributed, as are their consequences. On the one hand, financial firms often support and invest in firms that quash or stymie innovation and efficiency. Nesvetailova and Palan (2013) have explored how large corporations with near-monopoly power buy-up competitors or use various forms of pressure to contain threats to their established power, which they characterize as a kind of system-wide sabotage. The failure of an industry to compete on global markets–perhaps due to the gains made by workers through collective bargaining–can lead to a collapse which ravished whole economies and the impoverishment of whole areas. Bracking (2020) notes the kinds of ecological and social failure that results from the ratcheting down of environmental regulations by governments eager to make their jurisdictions competitive can result in short-term profit for investors in extractive industries but long term calamity for citizens.

In general, as de Angelis (2006) argues, the FIRE sector serves as the major vehicle through which the costs of so-called “market failures” are moved off the balance books of financial firms and corporations and transferred onto the shoulders of the public or of people. Failure, then is necessary and integral to financialization, but unevenly distrubted.

Finance as capital’s failed imagination

Finance, in a sense, represents capitalism’s form of partial but functional self-awareness. Of course, capitalism is not a living human being capable of self-awareness. Yet it is a system that, increasingly globally, is replete with autonomous feedback mechanisms, ways of knowing the world.

For Hayek (2007), perhaps the most brilliant 20th century capitalist theorist, free markets ideally represent a uniquely perfect knowledge systems. For Hayek, markets operate as price discovery mechanisms where competitive bidders collectively determine the true value of commodities, otherwise unknowable to any single actor. In this sense, markets are, writ large, as Beller (2021) suggests, a kind of world-encompassing meta-computer, constantly calculating (though a million independent, competitive bets) the world. In Martin’s (2015) reading of Hayek, capitalism with advanced financial markets is not only the fairest system, but also the truest. Though no individual can “know” the sublime market (and, indeed, failure to perfectly know the market is what, ironically, drives the differential behaviour of market actors of which the market is composed), the market has a kind of perfect, superhuman knowledge of the world.

In a similar but distinct fashion, and from the opposite side of the ideological spectrum from Hayek, Marxist geographer Harvey (2018) proposes that financial markets represent the central nervous system of capitalism. Financial markets, writ-large, take in market signals from around the world and, in response, send out prompts for investment and divestment, a process exacerbated and accelerated by recent advances in computing and telecommunications technology. Financial firms compete to study and evaluate firms, industries, sectors and whole nations, the better to speculate on their future fortunes and thereby determine where to advance or withdraw capital. I have suggested that, in contrast to the “central nervous system,” the metaphor of imagination may be more appropriate because it connotes the chaotic, conjectural and hallucinatory aspect of finance’s reckoning of the world (Haiven 2012). Approaching finance as capitals’ imagination also helps bring into focus the way that financial speculation relies on a multitude of acts of the individual human imagination, a position echoed by Beckert (2016) and Komporozos-Athanasiou (2021). My approach builds on Castoriadis’s (1997) framework which frames the imagination not as an individual quality of mind but as a material social force from which the institutions of social reality are crafted. In this sense describing finance as capital’s imagination seeks to identify the process by which it comes to understand and shape the world.

If finance represents capital’s means of self-reflexivity, then this imagination is constantly failing to accurately measure the meaningful value of things. It suffers from a debilitating and destructive solipsism, within which all worldly things are imagined exclusively in terms of risk, yield, and speculative profitability. It’s not simply that Financialized markets are constantly misvaluing stocks, bonds, derivatives, currencies and other assets; this is already part of the system: the failure of accurate measurement is key to many bedrock financial activities, like arbitrage. More importantly and damningly, financial market’s failure to properly imagine and value the world also jeopardizes human and environmental rights, communities and even the future of humanity itself. Functionally, it necessarily places the speculative concerns of a handful of major financial firms over material needs of millions, even billions of people. The financially-driven market’s imagination of the world is a fundamentally skewed one, but its power is such that, increasingly, the world is cut to measure its skewed imagination.

There is another, deeper failure of the imagination inherent to this situation. Financialization depends on most social actors, including notably those with political and economic power, internalizing finance’s imagination of the world and making it their own, the better to compete in a world financialization is creating. Frequently, major political and economic decisions are made based on a sense of inevitability, fatalism or a sense that no other options are possible, representing a profound failure of the imagination.

In sum, to identify finance as capital’s failed imagination of the world is to identify financialization’s reliance on the transformation of the human imagination, but also to contend with it as the means by which the system gains some measure of associative reflexivity. It’s not simply that how capital imagines the world is objectively wrong. That may be the case, but more dangerously still, its power is such that this mismeasured world in then instantiated in reality thanks to finance’s economic, political, social and cultural power.

Examining the financialized university

Up to this point, I sought to offer an overview on a range of interdisciplinary thinking on financialization with an eye to the question of failure. We will now turn to the case study of the finanicialized university to map the impacts and consequences of these dynamics in what is likely for most readers to be a familiar institution.

The North Atlantic anglophone public university (hereafter simply referred to as “the university”) has, over the period of financialization, undergone a profound shift. As Bousquet (2008) and McGettigan (2013) demonstrate, in the post-war period there reigned a conception of the university as a public institution, publicly funded, for the public good, dedicated to producing a new generation of skilled and competent citizens. Amidst financialization, university education has increasingly been stressed as a private (often debt-fueled) “investment” by individual students, through which they can accumulate human capital the better to compete in increasingly austere financialized labour markets. A similar shift has occurred in conceptions of academic research. As Hall (2020) and Fleming (2021) show, whereas in the post-war period research may have been seen instrumentally as serving industry or nation, since the 1990s academics have increasingly been tasked with conceiving of their own research as a kind of entrepreneurial activity seeking public and private investment with promises of lucrative returns or demonstrable “impact.” As Martin (2011) argues, this shift has been abetted by the introduction consequential systems of national and international metrics and ratings. Indeed, with increasingly regularity following the 2008 financial crisis, financial accounting and credit rating firms have been tapped to audit, provide reports and even recommend restructuring of public universities. These developments have exerted profound disciplinary power on university administrations who, (thanks in part to precisely these pressures) are increasingly influenced by and even drawn from corporate and financial worlds. As Whitener and Nemser (2012) observe, universities are increasingly seen as hubs for financial circulation, including, as Baldwin (2021) details, as partners in predatory urban redevelopment and real estate speculation.

As Meyerhoff (2019) notes, one ought not for a moment to fall prey to a nostalgia for the ideological purity of the post-war, pre-neoliberal, prefinacialized university which was built on a to reproduce long legacy of class stratification, gender oppression, racial injustice and colonial knowledge management (see also Bhambra, Gebrial, and Nişancıoğlu 2018). However, the financialization of public universities offers us a vital lens to understand the financialization process as a whole.

In the university sector this entanglement includes the ways in which high priced and often charismatic infrastructure building and maintenance ambitions create cozy relationships with private donors and lenders, financial institutions and real estate enterprises (see Engelen, Fernandez, and Hendrikse 2014). It includes the important ways that rising tuition fees drive an industry for providing, backing or collecting on student debt (The Debt Collective 2020). As Martin (2011) notes, it includes massive investment in privatized para-academic services including building maintenance and janitorial staffing, food services, technological services and professional administrative recruitment and consultions. It includes the recognition that universities’ captive and impressionable student body represents a lucrative source of monetized attention and data to be sold to advertisers, tech firms and more (see Bousquet 2008). On a broader, systemic level private firms that might have once trained professional recruits in-house now increasingly demand new hires arrive with specialized degrees in hand where job-ready skills have been instilled (at the students’ and public’s expense) in increasingly professionalized university programs (see Roth 2018). Even where specialized skills are not required or (as is often the case) not actually taught in universities, new workers who begin their careers heavily in debt and desperate for scarcer and scarcer work make desirable recruits who fear the dramatic consequences of being terminated and may accept lower remuneration or less favourable working conditions (see Wozniak 2021).

Fear of failure, mental health crisis

Generally, students in the financialized North Atlantic Anglophone universities are encouraged to imagine (largely correctly) that they will graduate into a world of debt, precarious employment and competition. As Roth (2018) shows, They are implicitly required to acknowledge that many if not most will fail to find the kind of secure and rewarding place within the capitalist economy for which they are told to strive. In an era where, as Feldman and Sandoval (2018) illustrate, on both sides of the Atlantic, universities are increasingly beholden to financialized metrics of performance and widely publicized quality and “return on investment” ratings (consequential for student and faculty recruitment and retention as well as public and private investment), implicit is the recognition that many if not most institutions will fail as well, since not all can succeed when metrics measure deviation from a norm and ratings are by their nature hierarchical. Even though, as. Bousquet (2008) makes clear, a fulsome rhetoric of exceptional “success” permeates the official doxa of financialized universities, underneath is the unspoken reality of inevitable mass failure. As we have already seen, this kind of necessity of failure is of a piece with the overarching logic of financialization,

What do we make of such a context, where both students and faculty in the financialized public university are expected to strive competitively for a financialized form of “success” in a system that necessarily depends on failure? It is perhaps not surprising that there has emerged what has been termed an “epidemic” of mental health crises among students and faculty (see Cole and Heinecke 2020). Scheffler (2019) credibly estimates 40% students sustained experiences, feelings, thoughts and behaviours associated with clinical depression or anxiety (see also Xiao et al. 2017; Lissovoy 2017). Daily newspapers and other media sources, as well as professional periodicals on university matters all confirm: students are profoundly and increasingly not only anxious and depressed but functionally debilitated by it (see Jones, Park, and Lefevor 2018). Requests from students for adjustments to their program of study (constitutionally guaranteed in the US, UK and Canada) as well as for university-based mental health services have grown exponentially in recent years (see Condra et al. 2015; Scheffler 2019). As Fleming (2021) and Berg and his colleagues (2016) show, Rates of mental ill health among faculty members are also alarming, and rising.

Such statistics need to be taken holistically, of course. For one, as Chateau (2020) points out, the same period has also seen the generally beneficial destigmatization of mental illness in these countries, making those who suffer more candid and forthcoming about their needs. For another, other factors clearly impinge: The generation which appears to be suffering mental ill health at record rates, those born around the turn of the millennium, are the same adults who grew up in an era of handheld computing and social media platforms, both of which have been significantly linked to mental distress (see Twenge 2017).

Yet as I theorize with Aris Komprozos-Athanasiou (2022), following on influential work by critics including Mark Fisher (2009) and Franco ‘Bifo’ Berardi (2009), we must not fail to link the rise in mental suffering to the overarching system of neoliberal capitalism in the period we have here been associating with financialization. In our view, this increase cannot be detached from the slow cancellation of the future and the rise of capitalist realism of the so-called end of history. For our purposes, the idea that financialized capitalist markets represent the perfect and inevitable horizon for human achievement manifests in daily and psychosocial life in a kind of financialized nihilism where one either enthusiastically, cynically or morosefully accepts that the purpose of existence is to hustle unto death (see Jaffe 2021). To accept the ideology of capitalist realism and its attendant (very material) economic pressures and stressors is to live in a kind of temporal wasteland. The future appears exactly like the present, leading to symptoms we commonly associate with depression or anxiety (see Hari 2018). As Lovink (2019) argues, These symptoms articulate themselves around impressions and practices of personal inadequacy, nihilistic ennui, world weary cynicism, hypersensitivity to the shadow of failure and desperate escapism.

For Rose (2018) and other critics of the psychiatric field, one regrettable but not unsurprising outcome is the profound biomedicalization of these experiences. Without discounting the very real suffering of those diagnosed with or enduring what they perceive to be “mental illness,” Rose questions the historicized discursive formation of such categories, especially in light of the manifold financial pressures that have impinged on their development. As Fisher (2014) argues, the diagnostic categories of mental ill health that today engrid our understanding and treatments for the experience of mental distress are consequently shaped by the pharmaceutical industry and by the overarching drive to “return” sufferers to a socially-constructed ideal of “normalcy” and “functionality” largely calibrated to participation in a neoliberal capitalist society. The financial motivations of publicly traded pharmaceutical corporations (eager to sell treatments to improve profit and share performance), insurance firms (eager to reduce health care expenditures), governments (eager reduce health spending) and other private and public actors must be tajken into account. As Cooper notes (2011), these help shape financialized society’s enthusiasm for biomedical “quick fixes” to mental distress, which usually come at the expense of more costly and transformative therapies, let alone the kind of socioeconomic shifts that might remove some of the stressors that lead to the distress in the first place.

This comes at a moment when, as Milburn (2021) points out, young people in the anglophone North Atlantic are increasingly caught out as chronic failures on two financialized fronts: on the one hand, they are unlikely to be able to benefit from the stability or rise in asset prices (notably housing), relative to shrinking real (ie. Inflation-adjusted) working class wages; on the other, the promise that an investment in huma n capital, in the form of university education, will lead to a secure middle-class life has been belied,

Indeed, as Horton documents, many young university students report a chronic feeling of failure, or of being destined to be a failure, or of being unworthy of or unable to return the “investment” made in them by their families (see also Sweet 2018). Yet as our research revealed, many also point towards the systemic and structural failures of universities to take mental distress seriously and provide sufficient services (Haiven and Komporozos-Athanasiou 2022). Some draw links between their suffering and the failure of the broader system of neoliberal capitalism, or link their distress to objectively distressing worldly phenomena related to that system, such as the unfolding global ecological crisis outlined above, which threatens to see younger generations inherit a crisis-ravaged world of seemingly inevitable social, economic and political decline (see Harris 2017).

These factors have encouraged us to ask: What if we were to conceive the mental health epidemic among students as a crisis of the financialized imagination? What if we were to, on a sociological level, approach this alarming wave of psycho-social suffering as a predictable failure of financialization? What if the crisis has found its focal point in the university not simply because it contains a critical mass of young people in a stressful environment but because the university itself is suffused by the claustrophobic logic of failure-reliant financialization that is so dramatically contributing to the problem in the first place? To the extent financialization grips that institution, it leaves less and less time and space for the kind of imagination-expanding affordances that once might have been sought in the university: time and space for rigorous imaginative play, for learning through mistakes, for experimenting with new ideas and perspectives. Perhaps learning has always been based on failure (fail, fail again, fail better), but today’s financialized universities are integrated into a perpetually failing system that teaches students to fear failure for the potentially catastrophic consequences it may have on their life chances.

Conclusion: The failures of movements to come?

What, then, of the possibilities of refusing, resisting and rebelling against such a system? As Porta and Diani’s (2014) collection demonstrates, conventional approaches to social movements in sociology and political studies tend to advance from a fairly mechanical perspective that focuses on studying social change through the discrete and delimited analysis of the measurable and observable success and failure of actors relative to their stated objectives and intentions. It is common to read assessments of social movements that analyze their success and failures in historical, social, economic and cultural context.

Yet as I have explored with Alex Khasnabish (2014), social movements are not so easily assessed, especially social movements arising in the period of neoliberal financialization. In the first place, while historians tend to frame 19th and 20th century movements in terms of durable forms of organization, hierarchy and objectives, many of today’s social movements exhibit a much more amorphous, decentralized and seemingly disorganized character (see Azzellini and Sitrin 2014). Graeber (2013) argues that academic experts tend to bemoan the lack of centralized organization and planning in recent movements against financialization, but that this orientation is flawed. Manifestations such as the global Occupy movement are not simply contesting this or that policy or cohering around this or that principle but are, in reality a protest against the way society is organized in general. For Graeber, their objective is not so much to “succeed” in a premediated and clearly stated goal, but to actively challenge and reinvent politics itself. This helps explain the disproportionate (and, to many eyes, counterproductive) time they dedicate to experimenting with new forms of communication, democratic participation and collective decision-making.

Inspired by this work, Khasnabish and I (2014) undertook ethnographic fieldwork with self-identified radical movement participants in the early 2010s. We derived a critique of conventional frameworks for assessing the success and failure of movements, arguing instead that it is often more productive to recognize that such movements exist in what we called a hiatus between success and failure. To explore this hiatus, we introduced two other terms: not-success and not-failure. We argued that attention to the ways movements dwell in the fraught in-between renders new insights. Importantly, these insights can serve movements, rather than extract knowledge from them for academic gain. Significantly, we argued that this hiatus is the space of the radical imagination, which emerges between participants amidst contradiction, conflict, difference and the struggle against seemingly unmoveable systems.

Approaching social movements beyond (or, more accurately, between) the antinomy of success/failure also permits us to recognize the temporal dimension of the radical imagination. As numerous scholars of social movement history argue, often the ideas, aspirations, organizational forms of movements appear to fail in their original time and place only to manifest again in seemingly unconnected struggles. Robin D.G. Kelley (2002) has demonstrated how, throughout the last four centuries, the “freedom dreams” of Black liberation have echoed throughout the Atlantic world and beyond, ricocheting between grassroots movements, popular culture, spirituality, sports and the experimental arts. Stevphen Shukaitis (2016) has argued that the radical European cultural avant-garde of the 19th and 20th centuries were almost never “successful” in their (often hyperbolically) stated revolutionary objectives, but they came to influence and animate movements in future generations.

Building on these insights, Komporozos-Athanasiou and I (2019, 2021) propose that we might fruitfully search for resistance to financialization, and in particular to the financialization of the Anglophone North Atlantic public university, within the mental health epidemic. Here we are seeking to move beyond the straightforward focus on the efforts of organized faculty, staff and students to oppose the neoliberal and financialized reconfiguration of these institutions which have, conventionally, included coordinated labour actions like strikes, student protests (including riots) and strenuous public awareness campaigns, as documented by Groot (2014). While such efforts are vitally important, over the period of neoliberal financialization such tactics have only met limited success (see Ferguson 2017).

In contrast to these more conventional forms of protest, we pose the intentionally provocative question: might students’ failure to cope, to participate and to strive to succeed might itself not be a more silent form of resistance? From a biomedical, clinical perspective, there are very real and very serious ways mental ill health, especially anxiety, impacts the lives and fates of millions of participants in university institutions. But we propose that, from a certain sociological angle, the increasing proportion of students citing these reasons for seeking learning accommodations and special consideration (or simply withdrawing from participation, officially or unofficially) might be understood as a form of mass refusal. If so, it would be a refusal highly germane to a moment of financialization where each individuated subject is exhorted from childhood to, in a single-minded, relentless and competitive fashion, seek market-oriented success see Walker et al 2021). We wonder if, in an uncoordinated, unintended but none the less concerted and observable way, the anxiety epidemic might be fruitfully read as, in part, a kind of social movement that cannot (yet) speak its name.

In order to substantiate such a proposition it is important to take stock of scholarship that acknowledges the way resistance to power often takes subtle forms, more passive than active. There is, of course, the long history of strikes where workers’ down tools and refuse to work. There is also a cross-cultural archive and repertoire of workers and oppressed people, in a less organized way, malingering, being lazy or pretending not to hear or understand instructions. These are part of what Scott (1992) calls the “weapons of the weak” and represent, collectively, part of a “hidden transcript” of resistance to domination that is rarely included in official histories. As Dane (1994) shows, feminist scholars have argued that the symptoms identified by male psychiatric professionals as “hysteria” may well have been conscious or unconscious forms of revolt against the strictures of patriarchy. The potentially self-destructive hunger strike is a form of passive resistance that has been used extensively to confront systems of domination (see Grant 2019).

It is with these in mind that we pose the thought experiment that suggests the “epidemic of mental ill health” on anglophone North Atlantic universities might be interpreted as a form of inchoate resistance to financialization. Financialization insists we all competitively strive to succeed in a system which, as we have seen, necessarily depends on and produces failure. The university has become a key locus of this process, wherein a generation that is emerging into adulthood comes to grips with their grim prospects. It would, then, not come as a surprise that students might turn towards dispositions often associated with “failure” as a means of passive, disorganized resistance. To be clear: there is nothing inherently negative about the kinds of distress we, today, discursively identify as “mental ill health,” and those that are so afflicted are not in any objective sense “failures.” However, within that cultural landscape of financialization, refusal or inability to compete to “invest” in oneself, through education for instance, is framed as an ontological failure. In the face of relentless pressures to so invest, the discursive and instuttuional field that surrounds mental ill health might be seen to offer a semi-legitimized venue to express a kind of refusal.

In assessing and exploring this form of resistance, we will not be well-served by conventional understandings of social movements or frameworks for assessing their success and failure. We will need new tools.

Works cited

Adkins, Lisa. 2019. “Work in the Shadow of Finance: Rethinking Joan Acker’s Materialist Feminist Sociology.” Gender, Work & Organization 26 (12): 1776–85.

Aitken, Rob. 2020. “‘A Machine for Living’: The Cultural Economy of Financial Subjectivity.” In The Routledge International Handbook of Financialization, edited by [“Mader, Philip and Mertens, Daniel and Zwan, and Natascha van der”], 369–79. London and New York: Routledge.

Allon, Fiona. 2014. “The Feminisation of Finance.” Australian Feminist Studies 29 (79): 12–30.

Appadurai, Arjun. 2016. “Banking on Words: The Failure of Language in the Age of Derivative Finance.” In . Chicago and London: University of Chicago Press,.

Arrighi, Giovanni. 1994. The Long Twentieth Century: Money, Power, and the Origins of Our Times. London and New York: Verso.

Ascher, Ivan. 2016. Portfolio Society: On the Capitalist Mode of Prediction. New York: Zone.

Azzellini, Dario, and Marina Sitrin. 2014. They Can’t Represent Us! Reinventing Democracy from Greece to Occupy. London and New York: Verso.

Baldwin, Davarian. 2021. In the Shadow of the Ivory Tower: How Universities are Plundering our Cities. New York: Bold Type.

Beck, Mareike, and Samuel Knafo. 2020. “Financialization and the Uses of History.” In The Routledge International Handbook of Financialization, edited by Philip Mader and Daniel Mertens and Natascha van der Zwan, 136–46. London and New York: Routledge.

Beckert, Jens. 2016. Imagined Futures: Fictional Expectations and Capitalist Dynamics. Cambridge MA and London: Harvard University Press.

Beller, Jonathan. 2021. The World Computer: Derivative Conditions of Racial Capitalism. Durham NC and London: Duke University Press.

Bello, Walden. 2013. Capitalism’s Last Stand?: Deglobalization in the Age of Austerity. London: Zed.

Berardi, Franco “Bifo.” 2009. The Soul at Work: From Alienation to Autonomy. Translated by Giuseppina Mecchiaand and Francesca Cadel. Los Angeles, CA: Semiotext(e).

Berg, Lawrence D, Edward H Huijbens, and Henrik Gutzon Larsen. 2016. “Producing Anxiety in the Neoliberal University: Producing Anxiety.” The Canadian Geographer / Le Géographe Canadien 60 (2): 168–80. https://doi.org/10.1111/cag.12261.

Bhambra, Gurminder K., Dalia Gebrial, and Kerem Nişancıoğlu. 2018. Decolonising the University. London and New York: Pluto.

Bichler, Shimshon, and Jonathan Nitzan. 2017. “Growing through Sabotage: Energizing Hierarchical Power.” Working Papers on Capital as Power. http://bnarchives.yorku.ca/512/.

Birch, Kean, and Fabian Muniesa, eds. 2020. Assetization: Things into Assets in Technoscientific Capitalism. Cambridge MA and London: MIT Press.

Blakeley, Grace. 2020. Stolen: How to Save the World from Finance. London: Repeater.

Blyth, Mark. 2013. Austerity: The History of a Dangerous Idea. Oxford and New York: Oxford University Press.

Bonefeld, Werner. 2019. “Critical Theory and the Critique of Antisemitism: On Society as Economic Object.” Journal of Social Justice, 9. http://transformativestudies.org/wp-content/uploads/Werner-Bonefield.pdf.

Bonizzi, Bruno, Annina Kaltenbrunner, and Jeff Powell. 2020. “Subordinate Financialization in Emerging Capitalist Economies.” In The Routledge International Handbook of Financialization, edited by Philip Mader and Daniel Mertens and Natascha van der Zwan, 177–87. London and New York: Routledge.

Bousquet, Marc. 2008. How the University Works: Higher Education and the Low-Wage Nation. New York: New York University Press.

Bracking, Sarah. 2020. “Financialization and the Environmental Frontier.” In The Routledge International Handbook of Financialization, edited by Philip Mader and Daniel Mertens and Natascha van der Zwan, 213–23. London and New York: Routledge.

Brecher, Bob. 2018. “Universities: The Neoliberal Agenda.” In Interrogating the Neoliberal Lifecycle: The Limits of Success, edited by Beverly Clark and Michele Paul, 127–42. London and New York: Springer.

Castoriadis, Cornelius. 1997 “Radical Imagination and the Social Instituting Imaginary.” In The Castoriadis Reader, edited and translated by David Ames Curtis, 319–37. Cambridge and New York: Blackwell.

Chakravartty, Paula, and Denise Ferreira da Silva. 2012. “Accumulation, Dispossession, and Debt: The Racial Logic of Global Capitalism—An Introduction.” American Quarterly 64 (3): 361–85.

Chateau, Lucie. 2020. “‘Damn I Didn’t Know Y’all Was Sad? I Thought It Was Just Memes’: Irony, Memes and Risk in Internet Depression Culture.” M/C Journal 23 (3).

Christophers, Brett, and Ben Fine. 2020. “The Value of Financialization and the Financialization of Value.” In The Routledge International Handbook of Financialization, edited by Philip Mader and Daniel Mertens and Natascha van der Zwan, 19–30. London and New York: Routledge.

Cole, Rose M, and Walter F Heinecke. 2020. “Higher Education after Neoliberalism: Student Activism as a Guiding Light.” Policy Futures in Education 18 (1): 90–116.

Condra, Mike, Mira Dineen, Helen Gills, Anita Jack-Davies, and Eleanor Condra. 2015. “Academic Accommodations for Postsecondary Students with Mental Health Disabilities in Ontario, Canada: A Review of the Literature and Reflections on Emerging Issues.” Journal of Postsecondary Education and Disability 28 (3): 277–91.

Cooper, Melinda. 2011. Life as Surplus: Biotechnology and Capitalism in the Neoliberal Era. Seattle: University of Washington Press.

———. 2019. Family Values: Between Neoliberalism and the New Social Conservatism. New York: Zone.

De Angelis, Massimo. 2006. The Beginning of History: Value Struggles and Global Capital. London and New York: Pluto.

The Debt Collective. 2020. Can’t Pay, Won’t Pay: The Case for Economic Disobedience and Debt Abolition. Chicago: Haymarket.

Ehrenreich, Barbara. 2009. Bright-Sided: How Positive Thinking Is Undermining America. New York: Picador.

Engelen, Ewald, Rodrigo Fernandez, and Reijer Hendrikse. 2014. “How Finance Penetrates Its Other: A Cautionary Tale on the Financialization of a Dutch University.” Antipode 46 (4): 1072–91.

Epstein, Gerald. 2020. “The Bankers’ Club and the Power of Finance.” In The Routledge International Handbook of Financialization, edited by Philip Mader and Daniel Mertens and Natascha van der Zwan, 437–47. London and New York: Routledge.

Erturk, Ismail. 2020. “Shareholder Primacy and Corporate Financialization.” In The Routledge International Handbook of Financialization, edited by Philip Mader and Daniel Mertens and Natascha van der Zwan, 43–55. London and New York: Routledge.

Feldman, Zeena, and Marisol Sandoval. 2018. “Metric Power and the Academic Self: Neoliberalism, Knowledge and Resistance in the British University.” TripleC: Communication, Capitalism & Critique 16 (1): 214–33. https://doi.org/10.31269/triplec.v16i1.899.

Ferguson, Roderick A. 2017. We Demand: The University and Student Protests. Oakland CA: University of California Press.

Fisher, Mark. 2009. Capitalist Realism: Is There No Alternative? London: Zer0.

———. 2014. Ghosts of My Life: Writings on Depression, Hauntology and Lost Futures. London: Zer0.

Fleming, Peter. 2021. Dark Academia: How Universities Die. London and New York: Pluto.

Foroohar, Rana. 2016. Makers and Takers: How Wall Street Destroyed Main Street. New York: Crown.

Fraser, Nancy. 2016. “Contradictions of Capital and Care.” New Left Review 100: 99–117.

Fukayama, Francis. 1992. The End of History and the Last Man. New York: Perennial.

Gago, Verónica, and Sandro Mezzadra. 2018. “A Critique of the Extractive Operations of Capital: Toward an Expanded Concept of Extractivism1.” Rethinking Marxism 29 (4): 574–91.

Gilbert, Paul, Clea Bourne, Max Haiven, and Johnna Montgomerie, eds. 2022. The Entangled Legacies of Empire: Race, Finance and Inequality. Manchester and New York: Manchester University Press.

Graeber, David. 2013. The Democracy Project: A History, a Crisis, a Movement. New York: Speigel and Grau.

Grant, Kevin. 2019. Last Weapons: Hunger Strikes and Fasts in the British Empire, 1890–1948. Berkeley, CA: University of California Press.

Groot, Gerard J.De, ed. 2014. Student Protest: The Sixties and After. London and New York: Routledge.

Haiven, Max. 2014. Cultures of Financialization: Fictitious Capital in Popular Culture and Everyday Life. London and New York: Plagrave Macmillan.

———. 2018. Art After Money, Money After Art: Creative Strategies Against Financialization. London and New York: Pluto.

———. 2020. “Culture and Financialization: Four Approaches.” In The Routledge International Handbook of Financialization, edited by Philip Mader and Daniel Mertens and Natascha van der Zwan. London and New York: Routledge.

Haiven, Max, and Alex Khasnabish. 2014. The Radical Imagination: Social Movement Research in the Age of Austerity. London and New York: Zed Books.

Haiven, Max, and Aris Komporozos-Athanasiou. 2019. “From Anxiety to Revolt? Against the Financialized University | ROAR Magazine.” ROAR Magazine. October 15. https://roarmag.org/essays/from-anxiety-to-revolt-against-the-financialized-university/.

———. 2021. “An ‘Anxiety Epidemic’ in the Financialized University: Critical Questions and Unexpected Resistance.” Cultural Politics Forthcoming.

Hall, Richard. 2020. “The Hopeless University: Intellectual Work at the End of the End of History.” Postdigital Science and Education 2 (3): 830–48.

Hari, Johann. 2018. Lost Connections: Why You’re Depressed and How to Find Hope. London and New York: Bloomsbury.

Harris, Malcolm. 2017. Kids These Days: Human Capital and the Making of Millennials. New York: Little, Brown and Company.

Harvey, David. 2007. A Brief History of Neoliberalism. Oxford and New York: Oxford University Press.

———. 2018. Limits to Capital. Essential David Harvey Series. London and New York: Verso.

Hayek, F A. 2007. The Road to Serfdom: Text and Documents. Chicago and London: University of Chicago Press.

Ho, Karen. 2009. Liquidated: An Ethnography of Wall Street. Durham NC and London: Duke University Press.

Hong, Grace Kyungwon. 2006. The Ruptures of American Capital: Women of Color Feminism and the Culture of Immigrant Labor. Minneapolis: University of Minnesota Press.

Horton, John. 2020. “Failure Failure Failure Failure Failure Failure: Six Types of Failure within the Neoliberal Academy.” Emotion, Space and Society 35: 100672.

Jaffe, Sarah. 2021. Work Won’t Love You Back How Devotion to Our Jobs Keeps Us Exploited, Exhausted, and Alone. New York: Bold Type.

Jameson, Fredric. 1997. “Culture and Finance Capital.” Critical Inquiry 24 (1): 246–65.

Jones, Payton J., So Yeon Park, and G. Tyler Lefevor. 2018. “Contemporary College Student Anxiety: The Role of Academic Distress, Financial Stress, and Support.” Journal of College Counseling 21 (3): 252–64.

Joseph, Miranda. 2014. Debt to Society: Accounting for Life under Capitalism. Minneapolis: University of Minnesota Press.

Karwowski, Ewa. 2020. “Economic Development and Variegated Financialization in Emerging Economies.” In The Routledge International Handbook of Financialization, edited by Philip Mader and Daniel Mertens and Natascha van der Zwan, 162–76. London and New York: Routledge.

Kelley, Robin D G. 2002. Freedom Dreams: The Black Radical Imagination. Boston: Beacon.

Klein, Naomi. 2104. This Changes Everything: Capitalism vs. the Planet. New York: Simon & Schuster.

Komporozos-Athanasiou, Aris. 2021. Speculative Communities: Living with Uncertainty in a Financialized World. Chicago and London: University of Chicago Press.

Konings, Martijn. 2015. The Emotional Logic of Capitalism: What Progressives Have Missed. Stanford CA: Stanford University Press.

Langley, Paul. 2020. “The Financialization of Life.” In The Routledge International Handbook of Financialization, edited by Philip Mader and Daniel Mertens and Natascha van der Zwan, 68–78. London and New York: Routledge.

La Berge, Leigh Claire. 2021. “A Market Correction in the Humanities — What Are You Going to Do with That?” Los Angeles Review of Books, August. https://lareviewofbooks.org/article/a-market-correction-in-the-humanities-what-are-you-going-to-do-with-that/.

Lapavitsas, Costas. 2013. Profiting Without Producing How Finance Exploits Us All. London and New York: Verso.

Lazzarato, Maurizio. 2012. The Making of the Indebted Man: An Essay on the Neoliberal Condition. Translated by Joshua David Jordan. Los Angeles: Semiotext(e).

Lissovoy, Noah De. 2017. “Pedagogy of the Anxious: Rethinking Critical Pedagogy in the Context of Neoliberal Autonomy and Responsibilization.” Journal of Education Policy 33 (2): 1–19.

Lovink, Geert. 2019. Sad by Design On Platform Nihilism. London and New York: Pluto.

Mader, Philip Daniel Mertens and Natascha van der Zwan, eds. 2020. The Routledge International Handbook of Financialization. London and New York: Routledge.

Mader, Philip, Daniel Mertens, and Natascha van der Zwan. 2020. “Financialization: An Introduction.” In The Routledge International Handbook of Financialization, edited by Philip Mader, Daniel Mertens, and Natascha van der Zwan, 1–16. London and New York: Routledge.

Maher, Stephen, and Scott M Aquanno. 2021. “The New Finance Capital: Corporate Governance, Financial Power, and the State.” Critical Sociology, online first. doi:10.1177/0896920521994170.

Mann, Geoff, and Joel Wainwright. 2020. Climate Leviathan: A Political Theory of Our Planetary Future. London and New York: Verso.

Martin, Randy. 2002a. Financialization of Daily Life. Philadelphia: Temple University Press.

———. 2002b. Financialization of Daily Life. Philadelphia, PA: Temple University Press.

———. 2007. Empire of Indifference: American War and the Financial Logic of Risk Management. Durham NC: Duke University Press.

———. 2011. Under New Management: Universities, Administrative Labor, and the Professional Turn. Philadelphia: Temple University Press.

———. 2015. Knowledge LTD: Towards a Social Logic of the Derivative. Philadelphia: Temple University Press.

McGettigan, Andrew. 2013. The Great University Gamble: Money, Markets and the Future of Higher Education. London and New York: Pluto.

Meyerhoff, Eli. 2019. Beyond Education: Radical Studying for Another World. Minneapolis and London: University of Minnesota Press.

Milburn, Keir. 2021. “Generation Left after Corbynism: Assets, Age, and the Battle for the Future.” South Atlantic Quarterly 120 (4): 892–902. https://doi.org/10.1215/00382876-9443448.

Nesvetailova, Anastasia, and Ronen Palan. 2013. “Sabotage in the Financial System: Lessons from Veblen.” Business Horizons 56 (6): 723–32.

Nölke, Andreas. 2020. “Financialization and the Crisis of Democracy.” In The Routledge International Handbook of Financialization, edited by Philip Mader and Daniel Mertens and Natascha van der Zwan, 425–36. London and New York: Routledge.

Pagliari, Stefano, and Kevin L. Young. 2020. “How Financialization Is Reproduced Politically.” In The Routledge International Handbook of Financialization, edited by Philip Mader and Daniel Mertens and Natascha van der Zwan, 113–24. London and New York: Routledge.

Pinker, Stephen. 2011. The Better Angels of Our Nature: Why Violence Has Declined. New York: Viking.

Porta, Donatella Della, and Mario Diani, eds. 2014. The Oxford Handbook of Social Movements. Oxford and New York: Oxford University Press.

Predmore, Signe. 2020. “Feminist and Gender Studies Approaches to Financialization.” In The Routledge International Handbook of Financialization, edited by Philip Mader and Daniel Mertens and Natascha van der Zwan, 102–12. London and New York: Routledge.

Pryke, Michael, and Paul du Gay. 2007. “Take an Issue: Cultural Economy and Finance.” Economy and Society 36 (3): 339–54.

Rose, Nikolas. 2018. Our Psychiatric Future. Cambridge and Medford MA: Polity.

Roth, Gary. 2018. The Educated Underclass: Students and the Promise of Social Mobility. London and New York: Pluto.

Roy, Ananya. 2012. “Ethical Subjects: Market Rule in an Age of Poverty.” Public Culture 24 (1): 105–8.

Scheffler, Richard M. 2019. “Anxiety Disorder on College Campuses: The New Epidemic (Preliminary Findings).” Berkeley, CA: Berkeley Institute for Young Americans. http://youngamericans.berkeley.edu/wp-content/uploads/2019/12/Anxiety_Disorder_on_College_Campuses_UCB_Study_FINAL.pdf.

Scott, James C. 2012. Domination and the Arts of Resistance: Hidden Transcripts. New Haven, CT: Yale University Press.

Shukaitis, Stevphen. 2016. The Composition of Movements to Come: Aesthetics and Cultural Labor after the Avant-Garde. Lanham MA and London: Rowman & Littlefield.

Soederberg, Susanne. 2014. Debtfare States and the Poverty Industry Money, Discipline and the Surplus Population. London and New York: Routledge.

Stiglitz, Joseph E. 2010. Freefall: America, Free Markets, and the Sinking of the World Economy. New York: WW Norton.

Sweet, Elizabeth. 2018. “‘Like You Failed at Life’: Debt, Health and Neoliberal Subjectivity.” Social Science & Medicine 212: 86–93. doi:10.1016/j.socscimed.2018.07.017.

Twenge, Jean M. 2017. “Have Smartphones Destroyed a Generation?” The Atlantic. September.

Varoufakis, Yanis. 2011. The Global Minotaur: America, Europe, and the Future of the Global Economy. 2nd edition. London and New York: Zed.

Walker, Carl, Peter Squires, and Carlie Goldsmith. 2021. “Learning to Pay: The Financialisation of Childhood.” In Growing Up and Getting By: International Perspectives on Childhood and Youth in Hard Times, edited by John Horton, Helena Pimlott-Wilson, and Sarah Marie Hall, 193–209. Bristol: Policy Press.

Whitener, Brian, and Dan Nemser. 2012. “Circulation and the New University.” TOPIA: Canadian Journal of Cultural Studies 28: 165–70. https://doi.org/10.3138/topia.28.165.

Wozniak, Jason Thomas. 2021. “The Miseducation of the Indebted Student: An Educational Argument for Full Student Debt Abolition.” Academe. April 1. https://www.aaup.org/article/miseducation-indebted-student

Xiao, Henry, Dever M Carney, Soo Jeong Youn, Rebecca A Janis, Louis G Castonguay, Jeffrey A Hayes, and Benjamin D Locke. 2017. “Are We in Crisis? National Mental Health and Treatment Trends in College Counseling Centers.” Psychological Services 14 (4): 407–15.

Zaloom, Caitlin. 2006. Out of the Pits: Traders and Technology from Chicago to London. Chicago: University of Chicago Press.