The following text was published in January 2024 and is the editorial introduction to a special section of the Journal of Cultural Economy on Finance Capital and the Ghosts of Empire. This project began over 7 years prior as a collaboration between me (Max Haiven), Clea Bourne, Johnna Montgomerie and Paul Gilbert to widen the lens of the emerging field of Critical Finance Studies to make an analysis of colonialism, empire and racialization central. The project has also included two gatherings and an edited collection (The Entangled Legacies of Empire: Race, Finance and Inequality, Manchester University Press 2023)

Financial capital and ghosts of empire: editorial

Clea Bourne, Max Haiven, Johnna Montgomerie and Paul Gilbert

Abstract

In this special issue, we take up the metaphor of the ghost to identify the seemingly intangible yet undeniable persistence of racism, empire and colonialism in finance and the global capitalist economy. In the aftermath of a world system built through colonialism, imperialism and their race-making projects, we all emerge haunted by racial colonialism. Despite this differently-expressed but shared global condition, we also live in a world marked by a willed forgetfulness, occurring more broadly, and especially in fields like economics and political economy. We argue that in order to understand the cultural economy one must confront the ghostly aspects of it. This special issue contributes to the cultural economy of finance by demonstrating pivotal ways in which finance actually works. We do so by refracting the lens of contemporary financial activity to reveal hidden ghostly power relations connecting the past of empire and colonialism with the present of financialisation and coloniality.

Accounting for ghosts of empire in studies of finance

The cultural economy of finance has rightfully called out the tendency toward simplified and depoliticised explanations of financial markets in mainstream financial theory; a tendency which overlooks the ‘wide-ranging social, cultural and political influences and impacts’ of financial events (Hardin 2017, 325). In keeping with this tradition, the interdisciplinary interventions in this special section contribute to ongoing attempts to account for the history, legacy and resonances of imperialism, colonialism and racial ordering in the past, present and futures of finance and financialisation.

Newer interdisciplinary fields such as critical finance studies are only just beginning to engage in a sustainable dialogue with fields such as postcolonial criticism, critical race studies and settlercolonial studies – see for example, this journal’s special issue on ‘Fintech in Africa’ (Langley and Rodima-Taylor 2022). Yet, as we have explored elsewhere, cultural economy’s own engagement with finance has – to its detriment – largely neglected questions of race and empire in their analyses of contemporary financialisation (Bourne et al. 2018). Writing for the Journal of Cultural Economy’s special issue ‘What Was Cultural Economy?,’ Sarita Malik (2022, 5) lamented cultural economy’s failure to consider relations between culture and ‘the logics of racialisation, representation and forms of resistance.’ This failure is perhaps surprising given cultural economy’s input from Stuart Hall, Doreen Massey and other critics of racial and colonial restrictions, and of spatial divisions, during the formative years of the field (See du Gay, Pryke, and Bennett 2022).

Here, cultural economy is not alone. Tilley and Shilliam (2018, 535) point out that a typical political economy student ‘might easily pass through undergraduate, postgraduate and doctoral study without ever being asked to reflect on the political economy of race,’ even as ‘extensive critical work has closely treated the ways in which gender and class “work.”’ Conversely, disciplines explicitly concerned with race and Black liberation are often missing ‘political and economic critiques of racialised dispossession,’ instead centreing on culture – or culturalism – as the organising force of human affairs (Burden-Stelly 2019, 74). Yet there is important scholarship confronting the origin myths of classic political economy (CPE). In Savage Economics, Blaney and Inayatullah (2009) exorcise the foundational principles haunting CPE’s intellectual origins, notably in the work of Adam Smith and other classic theorists of the Scottish Enlightenment. The word ‘savage’ in Blaney and Inayatullah’s book title refers to the pervasive othering of certain humans as ‘lesser’ and ‘savage,’ underpinning CPE’s inevitable instrumentalisation of all human life. While there is evidence these classic theorists wrestled with the pathological links between wealth creation and poverty in commercial capitalism, Blaney and Inayatullah (2009, 3) contend that CPE’s preference was to mask these pathological links, these ‘wounds’ of capitalism – including inequality, uneven development and colonial conquest – in an attempt to preserve ‘the purity of modern progress.’

In Decolonising Politics, Robbie Shilliam (2021, 7) argues that the intellectual roots and routes of our foundational understandings of the political world are ‘filtered through colonialism far more than we imagine to be the case.’ In his vast critique, spanning area studies, comparative politics, political theory and international relations, Shilliam confronts the colonial and racist logics of political theory and scholarship by detailing how it shapes ideas that acquiesce to racist agendas and the expansion of Empire. Shilliam (2021, 100) unveils the ghostly characteristics of the politics of assimilation arguing that this ‘colonial paradox of comparison’ accepts that difference exists analytically but not normatively, thus legitimising both the violence and domination required of colonial conquest.

The aim of this special section is to further foster the study of money, finance and the economy as imperial, colonial and racialised realities both past and present by using cultural economy as an epistemological and/or methodological lens. We reflect the reality that much of the phenomena associated with finance, finance capital and financialisation cannot be fully understood without referring to imperial, colonial and racialised realities, past and present (Bourne et al. 2018). Almost all of the institutions, technologies, processes and political economic relationships we might study emerge from contexts fundamentally shaped by histories of empire, colonialism, and systems of racial inequality and exploitation. And, as numerous scholars have demonstrated, there is a profound tendency for these social forces to reproduce and renovate themselves through the power relations of the worlds of finance. Our contributors illustrate several of these institutions, technologies, processes and relationships. Guerisoli and Mandirola (2022) examine neo-extractivism as a process involving institutions such as governments, banks and credit card providers who collectively promote ‘financial inclusion’ through conditional cash transfers or CCTs; financial instruments devised to incorporate the poor into global financial markets. Dattani (2023) looks at the Indian government’s launch of the Aadhaar biometric system. Once Aadhaar became widely enforced by Indian banks, insurers and mobile phone providers, the biometric technology was elevated to institutional status. Cordes (2022) explores the indigenous alternative currency, MazaCoin, as both a technology and social relation through which the Oglala Lakota people could mount a challenge against US financial systems, thereby asserting Indigenous sovereignty. Meanwhile, in our artists’ roundtable (Haiven 2023, 7), Adeyemo highlights a promotional film produced by Nigeria’s leading bank as yet another technology of global finance. Noting that ‘we have to speak about Africa,’ Adeyemo positions Africa’s relationship with global finance as one in which its populations have always been test subjects ‘for relations of debt bondage.’

Regrettably, contemporary discussions of debt, financialisation and neoliberal capitalism often overlook the ideological, technical, political and cultural roots of these phenomena in both colonial and postcolonial world orders. In this special section, and in the body of work of which it is a part, we take up the metaphor of the ghost to identify the seemingly intangible yet undeniable persistence of racism, empire and colonialism in finance and the global capitalist economy more broadly. In calling upon the spectral dimensions of these phenomena, we are not entertaining metaphysics: in the past two decades many critical social scientists (Fisher, Gordon, Saleh-Hannah) have been inspired by work in the humanities (Baucom, Derrida, Gordon) to develop theories of haunting and ‘hauntology.’ Their work helps explain how systems of domination we initially imagine as consigned to history continue to shape the present, encoded now in economic and social institutions that officially deny their presence.

The importance of accounting for the ‘ghosts’ of empire in the study of finance and financialisation is difficult to overstate. Recently, numerous authors have highlighted the way contemporary flows of financial investment, extraction, enrichment, control and immiseration follow channels cut previously by histories of geopolitical power and racialisation (See for example de Goede and Westermeier 2022; Haiven 2022; Hudson 2017; Safieddine 2019; Styve 2019; Styve and Gilbert 2023; Toussaint 2019; Wang 2018). More than a decade after the 2008 global financial crisis, and in an extended moment of rapid economic and political change, it is vital that our considerations of the past, present and future of finance and financialisation contend with these legacies, and that our visions of reform of (or rebellion against) these systems are well informed.

This special section marks an important milestone in a seven-year journey of interdisciplinary engagement with scholars currently grappling with intertwined histories of slavery, empire and finance. Between 2016 and 2019, the editors held two conferences, inviting international scholars, artists and activists to the UK for critical discussions. We assembled important interventions from financial scholars in different countries, tackling issues of race and empire. A key outcome of this collaboration was our edited collection, The Entangled Legacies of Empire (Gilbert et al. 2023), which foregrounds the interdisciplinary study of Empire through the lens of money, finance, credit and debt to understand how the categories of race, gender, and indigeneity are entangled with the practices of colonial expansion and wealth creation. This volume also makes a unique contribution to pedagogy by providing accessible case study chapters as teaching material on finance, race and Empire, relevant across the various constellations of academic disciplines and degree programmes in arts and humanities, social science and education.

In this themed section, we shift register to highlight research that interrogates Empire by using a cultural economy lens to interpret contemporary capitalism. We engage in questioning practices that ask: what is being missed when themes of race, empire and colonialism are marginalised from analyses of finance, debt and financialisation? What accounts for this marginalisation? What can be gained when they come into focus? And how might prioritising these themes open not only different scholarly horizons, but also different interdisciplinary linkages and pathways towards policy, practice and action?

We argue that in order to understand the cultural economy one must confront the ghostly aspects of it (Gordon 2013). In the shadow of a world system built through colonialism, imperialism and their race-making projects, we all emerge haunted by racial colonialism. And yet, in spite of this differently-expressed but nonetheless shared global condition, we also live in a world marked by a willed forgetfulness or forgetting. We borrow this term from settler-colonial literature, where it was developed to name the process whereby colossal injustices in the settlement of the West were successfully repressed in the memories of settler cultures (Saleh-Hanna 2015; and Cariou 2006 citing Siggins 1991). In our reading, this willed forgetting occurs much more broadly, and especially in fields like economics and political economy. This is pointedly illustrated by critiques of John Maynard Keynes, for example by Goswami (2018) who shows how the English economist’s ideas were shaped by unacknowledged encounters with Indian nationalist economists. Meanwhile, Patnaik (2017) shows the wilfully forgotten history of Keynes’ differential management of Bengali economics/lives and British economics/lives, where policies enacted in Bengal were recognised as too brutal for the UK. Yet even though the truth is submerged beneath dominant narratives, that which is willed to be forgotten, like an unquiet ghost, ‘eventually finds its way out into the light, often dragging horrid consequences along with it’ (Cariou 2006, 730). These consequences include debts owed, structural reparations, and even geographies of revenge (Cariou 2006; Haiven 2020; Saleh-Hanna 2015).

Indeed, many of the global issues that make headlines today, from climate change to climate adaption financing, from the politics of global debts to the question of ecological debt, from the question of reparations for slavery to questions over the repatriation of stolen land and artifacts, represent the ‘return of the repressed,’ the ghosts of empire returning to make their claims. To this end, this special section draws on the postcolonial tradition of engaging with haunting, ghostliness and spectrality to consider modern forms of dispossession, exploitation and repression (del Pilar Blanco and Peeren 2013; Gordon 1997/2008) brought about by financial capital and its historical roots in empire (Baucom 2005). Throughout this section, the ubiquity of ghosts and of haunting is an acknowledgement that history is always fragmented, marked by contestations for control of history’s meaning (Weinstock 2013). The discourse of ghosts is particularly useful because it immediately alerts us to the amorphous, untimely, intangible quality of these forces, and the way that the claims of the past arrive differently for diverse people and institutions. Haunting and ghosts offer us a theoretical tool to make sense of the active presence of unjust histories that cannot be denied but that also cannot ever be fully accounted for in both senses of the term: the crimes of the past can never be fully quantified, the accounts cannot be fully settled. Meanwhile, the account, the story, the testimony, is also perpetually unsettled and unsettling.

The language of ghosts is useful because there is more to the relationship between empire and finance than a simple recognition that the forces which shaped colonial expansion have left their mark on the contemporary world. The logics underpinning financial innovation and calculation, and the imaginaries underpinning speculative endeavours emanating from global financial centres bear ghostly traces of colonial predecessors (Gilbert 2020; Kish and Leroy 2015). The persistence of relations which shaped colonial rule forged its violent and extractive character, while simultaneously resting upon hierarchical classifications of governed populations along racialised lines (Bourne et al. 2018; Chakravartty and da Silva 2012). This constitutes the persistence of coloniality (Guermond and Sylla 2018), if not colonialism, and marks different forms of colonial relations, across different histories and geographies, several of which are represented in this special section.

We therefore invoke the ‘ghosts’ of empire here as a means of articulating culture and economy, refracting the relationship between the cultural imagination and the economic realm in order to progress the way we know, and make knowledge about, the cultural economy (Cooper and McFall 2017; Peeren 2014). We also acknowledge that for many cultures, ghosts are indeed real and walk in our midst; see for example, Joseph Tonda’s (2005/2011) work on political economy of central Africa, or Delaplace (2012) on Chinese colonialism in Mongolia. As a figure of cultural imagination, the ghost metaphor renders colonial invisibility and impotence tangible through narrative and visual techniques about contemporary finance (Baucom 2005). The ghost metaphor further serves as a methodological tool to detect different forms of shape-shifting through accumulated financial eras (Saleh-Hanna 2015).

The etymological connection between speculation and spectres alerts us to the way ghosts and the ghostly mediate the seemingly otherworldly power of financial markets, a power that seems at once to emerge from, as well as constrain, the future (Vogl 2015). The result here is four contributions, all employing ghosts of empire as an analytical tool in order to understand the concrete impacts of extractive financial relations, past and present, including exploited labour, exploited data, toxic residues and forced displacements. What binds the articles together is their attention to institutionalised, wide-reaching and repetitive praxes of colonial violence (Saleh-Hanna 2015). Each of the four contributions reflects different places and colonialities, which have emerged through different relationships to history and systems (Saleh-Hanna 2015).

Connecting the past and present of empire and finance capital

‘Financial Capital and the Ghosts of Empire’ contributes to the cultural economy of finance (CEF) by demonstrating some of the pivotal ways in which finance actually works (Hardin 2017). We do so by refracting the lens of contemporary financial activity to reveal hidden ghostly power relations connecting the past of empire and colonialism with the present of financialisation and coloniality. We take Mark Fisher’s (2014) definition of the power of ghosts as salutary: they are the ‘agency of the virtual.’ Here, virtual refers to the power of that which is no longer present but that shapes the present.

It is also the trace of all those alternative possibilities that were not allowed to become real. Thus, in terms of ghosts of empire, we not only summon up the memory of how European-led modern imperialism and colonialism shaped the world system we inherit today, we also allow ourselves to judge our present-day systems, structures, and institutions in terms of those alternatives vanquished by predecessors: other forms of globalisation, other modes of material provisioning, other cosmologies that were aborted, destroyed or subjugated in order that the present could be as it is.

As such, the ghosts of empire to which we refer take form as the afterlife of colonialism, in institutions that make global financial markets possible. Adapting Just’s (2019) argument, we contend that the reason so many ghosts of empire are invisible in contemporary finance is that the surfaces of contemporary finance have been ‘smoothed,’ enabling ghostly metaphors to walk among us, ‘sometimes passing as plain facts’ (Just 2019, 135). As Tuck and Ree (2013) make clear, contemporary individuals, institutions and systems encourage us to deny the persistence of ghosts, insisting violence is located in the past and can be forgotten or be assumed to be remedied, allowing the future to unfold according to the dominant logic. See, for example, Sismondo’s (2018) account of how pharmaceutical markets are made, quite literally, by ‘ghost-written’ publications. Spectrality-centred research refracts the smooth surfaces of contemporary finance by drawing attention to what lies beneath these surfaces – turning the murkiest corners into visceral knowing – and challenging seemingly incontestable oppositions, including ‘life/death, science/superstition, presence/absence, past/present, visible/invisible’ (Peeren 2014, 13).

Our aim is not merely to deploy empire, race or colonialism as a means of explaining away finance as ‘socially constructed’ – but to demonstrate that refracting cultural economy analyses through a lens of colonial repression can build a much needed methodological understanding of the relationship between race, empire and finance in the present. As Mark Fisher (2014) noted, accounting for ghosts – applying what Derrida identified as a ‘hauntological’ method – is an attempt to contend with the aforementioned ‘agency of the virtual.’ ‘The late capitalist world,’ wrote Fisher (2014, 18), ‘governed by the abstractions of finance, is very clearly a world in which virtualities are effective.’ Our contributors engage in a set of interdisciplinary investigations, drawing on literatures including critical race studies, critical urban studies, cultural studies, decolonial and postcolonial studies, critical political economy, digital platform studies, indigenous communication, visual culture, art and design, as well as sociology and historical studies. We argue that the ghostly connections between empire and contemporary finance must be recovered, as these invisibilities limit prospects for social change.

The special section addresses a readership interested in a number of fields that intersect with cultural economy including: anthropology of money and finance, critical finance studies, cultural studies, economic geography, economic history, economic sociology, political economy, postcolonial and decolonial studies, and social studies of finance. These fields are diverse but converge around a shared concern with addressing the marginalisation of histories, legacies and ongoing realities of empire, colonialism and global racial ordering. The section will also be of interest to humanities and social science scholars engaged more generally with hauntology and spectrality, particularly in literary and media studies.

We write our editorial at a critical juncture for finance capital and decolonial relationships. The world has endured a long global pandemic, in which millions have died. We acknowledge this tremendous loss of life, loss of livelihood and wellbeing. The pandemic at once unveiled and masked continuing relations of empire and finance capital around the world. This critical juncture has been further marked by international warfare with long-lasting consequences for trade, supply chains, migration and global security. Modern imperialism continues, albeit sometimes with the addition of new actors. In Africa, for example, rivalry between European and American capital for resources and control of finance capital persists. Meanwhile, China’s decades of expansion into the Global South is reaping new consequences for debt relations, all the while presenting itself as a South-South alternative.

We have watched with great concern as global debt has fundamentally shaped how once-colonised nations were able to deal with the pandemic, as well as with the profound threats of climate change. Partly in response, calls for financial reparations are on the rise. Reacting to various reparations movements, several top-league universities and corporations have set up slavery reparation funds. State-level initiatives include the CARICOM Reparations Commission, representing colonies (past and present) of the Commonwealth Caribbean. The climate crisis is a new focal point for financial reparations between ‘the West and the Rest.’ In November 2022, the UN Climate conference reached a breakthrough agreement on climate reparations for the world’s most vulnerable countries. How closely the most vulnerable countries map onto race and empire was a spectre of these negotiations – a spectre called forth by Barbadian Prime Minister, Mia Mottley in her speech to climate delegates:

I come from a small island state that has high ambition but is not able to deliver on that high ambition because the global industrial strategy that we have has fault lines in it. Our ability to access electric cars or our ability to access batteries or photovoltaic panels are constrained by those countries that have the dominant presence and can produce for themselves. But the Global South remains at the mercy of the Global North on these issues. (Mottley 2022)

Interdisciplinary approaches to financial spectrality

Explorations of spectrality in financial markets span several fields, albeit with a heavy European focus. For example, Cipolla (1956) connects spectrality, value and money in his discussion of ‘ghost’ or imaginary money in Europe’s middle ages, when ghost units were used in daily calculations of price for accounting purposes – treated as coins, but seldom, if ever, actually coined. These ghost pounds became every bit as ‘real’ as their metal counterparts, acting as distant forerunners of ‘fiat’ money in modern states (Cameron 2015 citing Cipolla 1956). Connecting medieval ghost pounds with twenty-first century global money supply, Cameron (2015) argues that money, even when it has physical representation, has always been ambiguous, extraterritorial – even ghost-like – when unconstrained by legislature. ‘It is because money is essentially nothing that also means that it is potentially everything – money is a “meta-commodity” that is universally applicable’ (Cameron 2015, 14). The spectre of ‘nothingness’ attached to global money, contends Cameron, is crucial to its capacity to carry and store value in advanced economies.

Analyses of medieval ghost pounds and the ethereality of modern money echo discussions of spectrality, value and the commodity originally invoked by Karl Marx in the first volume of Capital, published in 1867. The introductory chapter of Capital, alone, contains references to ʻghostly objectivity’, ʻsensuous supersensuousness’, ʻmysteriousness’, ʻmetaphysical subtleties’, the ʻfantastic’ and the ʻabsurd’ (Arthur 2001). Famously, Marx (1867/1976, 342) is known for identifying capital as ‘dead labour, which vampire-like, lives only by sucking living labour.’ But Marx’s broader interest in spectrality was bound up in understanding the elusive nature of value emanating from capitalism’s increasing tendency to displace material processes of production and circulation. Marx argued that value emerged from the void as a ‘spectre,’ which haunts the real world of capitalist commodity production, and takes possession of it (Arthur 2001). Many contemporary authors who draw on spectrality theory trace their thinking back to Marx’s work and, even more directly, to Derrida’s Specters of Marx, published in 1993; as well as a later symposium featuring Derrida, Negri and others (See Negri 1999/2008). Derrida immortalised Marx’s debates on spectrality when he advanced the term ‘hauntology’ as part of his theory of capital, in which objects, labour and capitalist means of production are transformed into use-value conditions via phantasmagoric processes, whereby the constructed commodity form is positioned as ‘distinct from yet haunted by its soon-to-be born “use-value” under capitalism’ (Derrida 1994, 161).

Also key to Derrida’s theory of hauntology are the claims that the past might have on the present. Writing in the wake of the collapse of the Soviet Union and its spheres of influence, Derrida’s turn to the ghost, based on his reading of Hamlet, speaks to the way the ghost calls to us for a response, to take response-ability in a moment when ‘time is out of joint.’ Contrary to Marxist-Leninist orthodoxy that sees The Party as the only viable response to the ‘spectre’ of Communism, Derrida argued that there are many ways of responding to the call that the ghost of Marx still makes to critics of capitalism. It is this radically open-ended possibility of response to injustice that breaks the future free of the prematurely declared ‘End of History,’ so much in the vogue at the time of Derrida’s writing.

While the spirit of Derrida is present throughout this special section, our contributors recognise capitalism to be racialised and persistently shaped by the spectres of coloniality. To this end, the special section’s diverse explorations of hauntology and spectrality captures moments of use-value which Derrida did not account for in his analysis; moments shaped by phantasmagoric processes of empire, colonialism and race. In doing so, our contributors seek to respond to our ‘out of joint’ times and the enduring call to do justice to the past, to reimagine the present, and open the possibility to alternate futures. They also all speak to the parasitic qualities of finance that, according to Costas Lapavitsas (2013), ‘profit without producing’ and do so, through what can be understood as a global system of abstract and decentralised violence (LiPuma and Lee, 2004).

Vampires, zombies, ghosts and other spectral monsters of the market

Spectral theories of value have been applied to contemporary financial markets, particularly following financial crises, when numerous spectres – ghosts, zombies, vampires and Doppelgängers – are conjured from post-crisis financial trauma. In the wake of the 2008 global financial crisis, interdisciplinary work on financial spectrality conjured visible, fearful monsters of the horror genre. Vampires, zombies and Doppelgängers emerged as a response to the ‘new magic’ of late capitalism and speculative finance (Nelms 2012). Though distinct in Western cosmology and especially in popular culture, all these undead or uncanny actors speak to the power of ghosts, insofar as they signal the past returning for some kind of vengeance, the settling of debts or the (violent) balancing of the books.

Montgomerie (2016) holds that sanguineous metaphors have been popular historically for depicting the role of finance within the economy as ‘bleeding it dry,’ with vampires and zombies, particularly, possessing the singular objective ‘to feed’ on human prey (Montgomerie 2016). Vampires, as financialised monsters of our age, conjure associations with blood-sucking parasitic characteristics of high finance (Crosthwaite, Knight, and Marsh 2014; Harman 2010; McNally 2011). Today, the vampire is liminal, hollow yet driven, and calculatingly psychopathic. Operating in the shadows of society, the vampires of financial markets suck life out of the human economy a little bit at a time (Montgomerie and Cain 2019). The vampire tells one story of the nature of elite rule under financialisation. By contrast the zombie metaphor evokes a more violent image of how finance stays alive despite appearing to be dead, following global market seizure (Fisher 2013; Giroux 2010; Harman 2010; Peck 2010). This is perhaps why the zombie remains the most pervasive spectre in financial critiques.

The zombie metaphor first materialised in the 1980s as a macroeconomic term to describe insolvent Savings & Loan (S&L) organisations kept alive by federal government guarantees during the USA’s S&L crisis (Nelms 2012). Later in the 2000s, the zombie metaphor was used to describe the Japanese financial system, where endless public subsidies to banks resulted in systemic erosion of economic vitality. The spectral lesson to be learned was that ‘feeding the Zombie only breeds more’ (Montgomerie 2016). Concurrently, in insurance markets, the ‘zombie fund’ became a widely-used term for with-profits life insurance funds that had closed to new business, remaining half-alive while their portfolio of liabilities is run-off. In the post-crisis decade, vampires and Doppelgängers slunk back into the shadows, but the zombie persisted. For instance, the number of zombie firms increased; hiding in plain sight, employing thousands, yet unable to cover debt servicing costs from current profits over an extended period (Selfin and Nimmo 2019). Such monstrous figures capture the public imagination in a financial system itself seen as spectralising, that is, ‘producing subjects that stand apart from the rest of society, either, at the top, as unaccountable or, at the bottom, as expendable’ (del Pilar Blanco and Peeren 2013, 92).

As with Montgomerie and Cain (2019) writing before us, we have no desire to put these metaphors into competition with one another. Metaphors tell stories in different ways. As McNally (2011) points out, the monstrous entity to which Marx most frequently likened capital is the vampire, a metaphor conjuring up something demonic, and like the zombie, a life-draining energy. The zombie similarly, bites human flesh and poses the risk of contagion. Yet these two metaphors differ distinctly. Where the vampire embodies the image of an ‘elite aristocrat with wealth and power capable of violence without fear of repercussions,’ the zombie is unthinking, unfeeling, and in relentless pursuit of its single objective, its food source (Cain and Montgomerie 2019, 2).

For us, the ghost offers more than other monstrous metaphors. For one thing, the ghost metaphor is culturally inclusive and encompasses diversity, since ghosts take many forms and exist in many cultures. Unlike the vampire, the ghost can represent both malevolence and also the benign, the powerful as well as the powerless. Unlike the zombie, ghosts may think and feel: ghosts may often mourn, or evoke nostalgias – such as economic nostalgias (See Bourne et al. 2018). Unlike the vampire, whose shape-shifting and invisibility is governed by the need to feed, a ghostly presence may go undetected indefinitely. But above all, we see the ghost metaphor as a constructive, healing metaphor, principally because the ghost calls our attention to something urgent, something that must be done. Furthermore, the process of ghost-hunting can be productive, where we bring the ghost to life on its own terms, and treat the ghost respectfully, without abandoning or disappearing it again (Gordon 1997/2008; 2011).

For ghosthunting to have healing powers, we must take a wide look around and a deep look inside global systems. Otherwise, our attention is too easily drawn to specific ‘unacceptable’ faces of capitalism (De Cock and Nyberg 2014). For instance, the monstrous spectres infamously conjured by the 2008 financial crisis typically embodied the causal greed of visible actors and institutions within the shadow banking system. These spectres successfully invoked shadow banking’s potentially uncontrollable threat to society (Ertürk 2016; Just 2019; McNally 2011). Much of post-crisis scholarship depicts these financial spectres as moving throughout circuits of cultural exchange, largely detached from the politico-economic system which gave them their life-threatening energies (McNally 2011). McNally problematises this version of spectrality for its tendency to highlight individual actors and institutions as temporary spectres for public derision. He counters that ‘nowhere in the discourse of monstrosity today do we find the naming of capitalism as a monstrous system’ (McNally 2011, 3).

McNally’s observation foreshadows more recent work, which sets out to depict the wider economic system itself as the ‘unthinking monster in relentless pursuit of a single objective,’ where short-term profits are synonymous with ‘human brains’ (Montgomerie 2016. See also Montgomerie and Cain 2019). The zombie economy as all-encompassing spectre corrects the narrow focus of previous critiques, by invoking the zombie to represent widespread stagnation resulting from the extended period of ultra-low interest rates across the world’s largest economies. As a spectre representing systemic stagnation, the zombie economy embodies (among other things) all the unproductive businesses that staggered on, generating just sufficient profits to continue trading, but without the innovation, dynamism or investment necessary to sustain real growth (Selfin and Nimmo 2019).

Why is it so important to apply spectrality to the economic system itself, rather than solely to its individual actors? Here, we return to the ghost metaphor – and to McNally (2011) – who argues that the very insidiousness of the ‘capitalist grotesque’ has to do with its invisibility, that is to say, the ghost-like ways in which monstrosity becomes normalised and naturalised, as it colonises the essential fabric of everyday life. What is most striking about capitalist monstrosity, therefore, is its ‘elusive everydayness’ (McNally 2011, 1). To this end, we can conceive of all modern-day financial processes as spectral, most notably through the current phase recognised as neoliberal capitalism, in which our world is reconfigured as one of inescapable interconnections – ‘ungraspably complex, only partially material, accelerated to the point of disappearance, capable of occupying multiple spaces at once’ (del Pilar Blanco and Peeren 2013, 92–93).

Unlike vampires and zombies, the ghost metaphor is recognised as more ethereal and elusive. Finance, as Just (2019) argues, ‘does not articulate its ghostly logic, but runs according to it.’ Thus, the ghost is a more significant metaphor for the entire financial system, because the ghost does not merely signify what finance is like but what finance actually is (Just 2019). The most ghostly characteristics of finance surround its omnipresence, its smoothness, and its myths masquerading as fact. Ghostly critiques of financial markets therefore seek out ‘psychic’ investments – those curious attachments which bind us to money and projected futures, as well as the unseen power behind speculative transactions and parts that cannot be grasped by rational thought (Just 2019; Samman 2015). Our contributors seek out these curious psychic attachments. Collectively, our contributors take up McNally’s (2011, 7) call to map the everyday-ness of unseen operations in financial markets – and their ‘demonic power.’ Our contributors all employ the ghostly metaphor because straightforward narrative strategies regularly fail to register the reality of the unseen forces of capital (McNally 2011).

Spectrality in postcolonial and cultural theory

An especially influential seam of research for this special section comes from postcolonial and cultural theory. Postcolonial theory has relied extensively on the idea of haunting in order to bring awareness of colonial history to the present, while revising the conception of ‘contemporary nation and of cultural relations’ (O’Riley 2007, 1). The haunting of the colonial is often motivated by a desire to relate to the Other, the silenced, the hidden, but more importantly to mobilise memory in order to situate resistance (O’Riley 2007). This desire is affective in nature, particularly since ghosts in postcolonial theory are so often symptomatic of trauma and wounded historical experience (del Pilar Blanco and Peeren 2013). Indeed, haunting is pervasive in postcolonial thought precisely because of its affective dimension, in which ghosts create a sense of ‘the imminently important, present, and disruptive’ (O’Riley 2007, 1). To this we add that, in many non-Eurocentric cosmologies, ghosts and ancestral spirits are not immediately considered unnatural or abnormal, and are often seen as helpful or at least ambivalent actors in the world. Tuck and Ree (2013) have proposed that accepting one’s status as a ‘once and future ghost’ can provide a platform for solidarity and resistance to forms of (neo)colonialism, which insist the past is over-and-done and deny the continued political-economic violence of the past. Similarly, Gilman-Opalsky has theorised the way that social movements ‘become ghost[ly]’ as a way of claiming the debts of their biological, cultural or chosen ancestors (2016).

This affective dimension, still largely absent from certain critiques of finance, has helped us to develop our argument as follows: if all of finance is, in part, spectral, it has evolved this way through the structures of empire, the effectiveness of which were contingent on partial visibility. Rather like Just’s (2019) discussion of smoothness, the postcolonial view of spectrality does not deem ghosts to be invisible, but rather concealed, not only very much alive, ‘but a seething presence’ (Gordon 2013, 107); often contained, even repressed, yet ‘ceaselessly directed toward us’ (2013, xvi). Haunting therefore becomes both a language and experiential modality through which repressed, unresolved social violence and abusive systems of power make themselves known (Gordon 1997/2008). Much as McNally emphasises the systemic over the ‘monstrous’ individual, attending to postcolonial hauntings draws us away from accounts that emphasise haphazard and individual acts of colonial policy-making, and refocuses attention toward the colonial histories that endure within contemporary (financial) formations.

An important seam of postcolonial inquiry into connections between the ghostly and unseen financial operations comes from studies of the transatlantic slave trade and its role in the genesis of global insurance markets. In Specters of the Atlantic, Ian Baucom’s (2005) explicit analysis of the British slave ship Zong 1781 massacre exposes how this horrific, lethal and world-defining industry not only transmuted African humans into commodities whose trade and labour filled European and American bank accounts; early insurance practices also transformed enslaved peoples into objects of financial speculation. These spectres continue to haunt contemporary financial markets. Recent inquiries into the proceeds of slavery reveal its stain on many of today’s most influential financial institutions (Hall 2018; Hall et al. 2014). Indeed, as Kish and Leroy (2015) illustrate, the transatlantic slave trade inaugurated a series of methods by which Black people and whole nations became the testing grounds for new financial technologies. This topic is later revisited by Wang (2018), analysing financialisation at the intersections of financial speculation, the prison-industrial complex and the carceral city in contemporary USA. Similarly, Bhandar (2019) and Park (2016) have illuminated ways that financialised notions of real estate speculation find their root in histories of colonial expropriation of indigenous peoples in North America. The cultural economy of finance must therefore heed the advice of Chakravartty and da Silva (2012) and Taylor (2019) to attend to the ways that intersections of financial capital and race are not only ways of punitive exclusion but also ways of predatory inclusion, the ghosts of which haunt the present.

Ghost-hunting as analytical tool

How then do our contributors make financial capital and the ghosts of empire visible in this special section? Throughout history, ghosts, spirits and spectres have taken many forms: as figments of the imagination, divine messengers, benign or exacting ancestors, and even ‘pesky otherworldly creatures’ returned from the dead (del Pilar Blanco and Peeren 2013, 1). Ghosts interrupt ‘the presentness of the present,’ indicating that beneath the surface of received history lurks another narrative questioning the authorised version of events (Weinstock 2013, 63). Ghosts may be imperceptible, they may choose to communicate via telepathic communication, or go so far as to possess people, sometimes violently. Ghostly intentions are diverse: ghosts may reveal hidden crimes, exact revenge, provide alternative healing or divination, or simply search for a way to pass on (del Pilar Blanco and Peeren 2013). Importantly, for this special section, the ghost is not simply a dead or missing person, it is a cultural-economic figure. Spectrality theory, therefore, provides a means of knowledge production and a way of richly conjuring and narrating the damage of coloniality – ‘the liens, the costs, the forfeits, and the losses’ accumulated over time (Gordon 1997/2008, xvii). Investigating financial capital and the ghosts of empire in precisely this manner can – to paraphrase Gordon (2013, 107) – lead to that ‘dense site’ where history and subjectivity make economic life.

Guerisoli and Mandirola (2022), in this section, use the ghost as instrumental metaphor to articulate the interrelation between culture and economy through their examination of contemporary global capital and financialisation in Argentina, Chile, and Ecuador. Here, they argue that South American neo-extractivism represents a rebirth of colonial/postcolonial blanqueamiento or ‘whitening,’ designed to improve race to a supposed ideal of whiteness. The co-authors draw on an expanded concept of extractivism, which relies on the intensive exploitation of natural resources to reinvigorate welfare programmes through financialisation, incorporating new forms of credit and consumption. In exorcising the ghost of blanqueamiento, Guerisol and Mandirola interrogate disturbing intersectionalities, where millions of citizens in South America’s urban areas were able to accumulate, buy, and borrow, even as indigenous, mestizo and afro-descendant populations were confronted by violent expulsion. As Guerisoli and Mandirola point out, neoextractive policies favour urban spatiality, which in turn intersects with race. Thus, economic policies designed to ‘lift up’ populations in reality operate by demarcating different groups of human beings: such is the basis of racial capitalism (Bhattacharyya 2018).

Methodologically, all our contributors are ghost-hunting, yet in different ways. In Ashley Cordes’ article, ghosts are located in the still-living connections between past and present for indigenous communities entangled in the colonial processes of extraction and settlement, only to then struggle with what independence or sovereignty means in the context of global financial capital. Cordes uses indigenous storywork, a method that creates a dynamic memory of phenomena which include the Spirit World, to interpret MazaCoin, an indigenous cryptocurrency launched as a solution to the socio-economic issues of the Oglala Lakota people in modern-day South Dakota, USA. MazaCoin as a ‘resurgent technology’ and ghostly artefact connects contemporary technologies of financial capital with the past and present of US settler colonialism. Cordes’ storywork offers a telepathic message from the past, as it mediates the financial goals set by ghosts of Indigenous leaders across time and space. Cordes frames MazaCoin as oppositional work, as she exorcises the ghosts of Indian/Federal treaties calling for tribal land to be returned.

Also in this section, Kavita Dattani (2023) explores the unfettered capture of data in India via a state-led identity system, backed by the fintech industry. Here, Dattani engages with the rapid advance of ‘data colonialism,’ described by Couldry and Mejias (2019) as the combined predatory extractive practices of the past with abstract quantification methods of contemporary computing. However, where Couldry and Mejias identify data colonialism as a new universal regime of appropriation, Dattani traces a clear path between modern identity surveillance and modern fingerprinting and identity systems, and their ghostly origins under colonial governance. In examining the effects of fintech surveillance on India, the world’s largest population, Dattani not only exorcises the vampiric nature of fintech as it sucks the ‘blood’ or data out of the Indian ecosystem, she also counters the problematic notion that twenty-first century data colonialism has somehow shifted the epicentre of colonial extractive powers from the global south to the global north (Couldry and Mejias 2019).

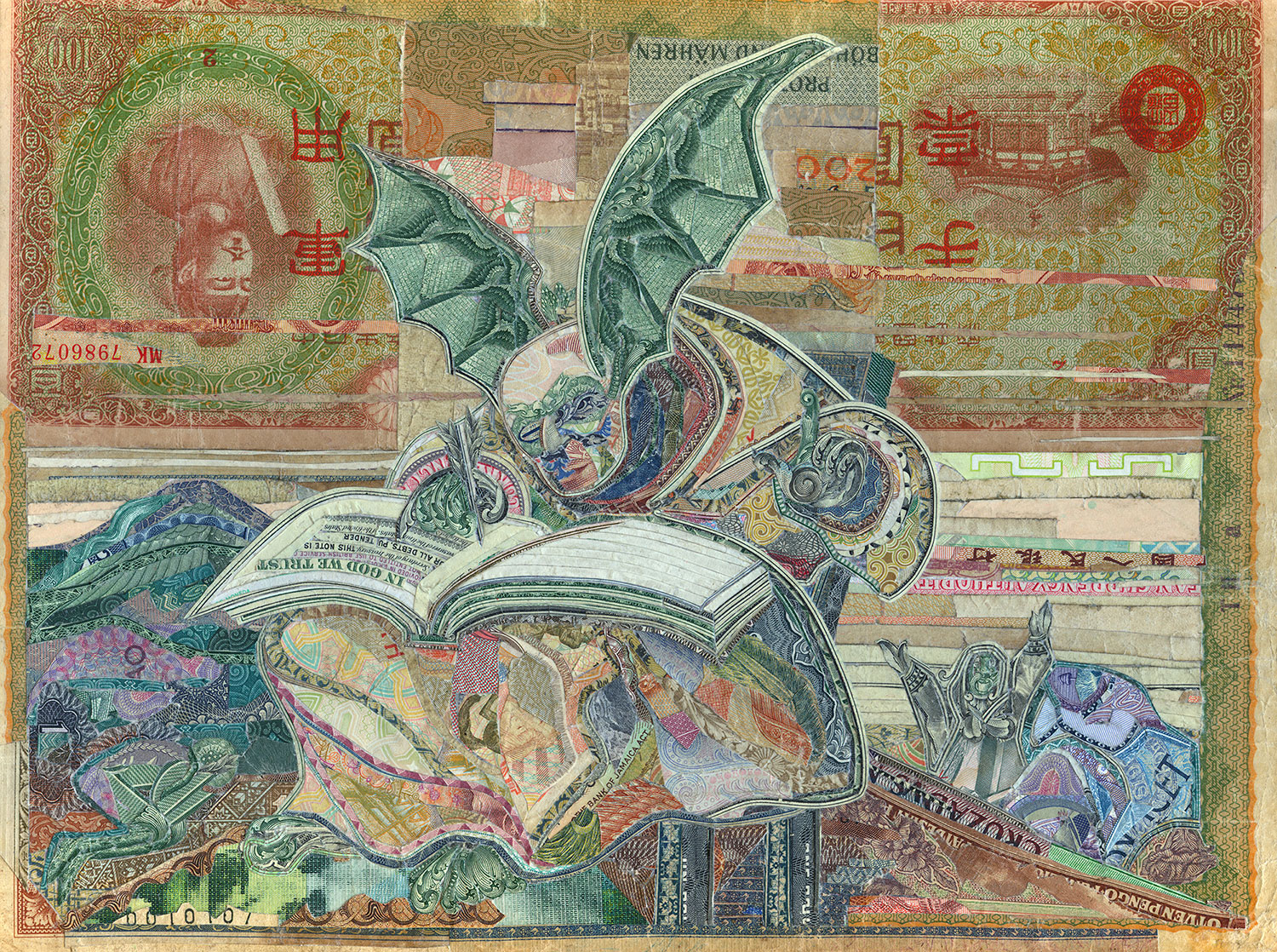

Our final contribution is an artists’ roundtable moderated by our co-editor Max Haiven (See Haiven 2023). The roundtable features Dele Adeyemo, Ahmed Ismaldin, Bahar Noorizadeh and Gary Zhexi Zhang, all artists who were asked to respond to the topic of unpayable debts as part the transmediale festival’s This is Not Anarchy, This is Chaos symposium in Berlin. The roundtable starts with a provocation from Denise Ferreira da Silva: that unpayable debt helps to account for the deep entanglements of colonial, racial and capitalist power in our modern world. da Silva (2022) defines ‘unpayable debt,’ as the way certain people or whole populations are encumbered by ‘debts that are not theirs to pay,’ but which they are forced nonetheless to repay … and which they cannot possibly repay. Our artist-contributors consider how the spectre of debts-from-above and from-below enable modern debt guardians to shape reality for peoples of the Global South, with some notable discussions of the Middle East and Africa.

Moving away from abstractions of finance

At the root of all four contributions is a desire to move away from the usual abstraction of finance in order to ask grounded questions about whose bodies and selves were made vulnerable within certain cultural economies of financial capital – and when, why, and how – and whose were not. This is not to say our contributors offer cultural-economic perspectives as the opposite of abstraction: finance is and always has been both cultural and social. Rather, it is the invisible and marginalised cultural economy that our authors bring to the fore. In their critical accounts of contemporary finance, our contributors embark on different forms of ghost-hunting in different geographic locations, with ghosts often occupying liminal positions between visibility/invisibility, life/death, and materiality/immateriality, there/not there, presence/absence (del Pilar Blanco and Peeren 2013; Gordon 2013). Ghost-hunting requires a conscious ignoring of conceptual boundary between intellectual and visceral, history and present, finance and the ‘real’ economy.

Together, these four articles construct an exorcising framework through which

terror and unpredictability, grief and unrest, guilt and injustice, ancestors and demons can be called upon to empower and liberate us, not from the fact that we have been violated or even that violation continues, but from a condition of inability to locate the heart and soul of the problem. (Saleh-Hanna 2015, 7–8)

At the same time, these contributions collectively recognise that under current global circumstances, wherein legacies of colonialism, empire and racialisation continue to perpetuate structural violence in many forms, perhaps the ghosts of financial capital are here to stay. As Tuck and Ree suggest:

Haunting … is the relentless remembering and reminding that will not be appeased by [colonial] settler society’s assurances of innocence and reconciliation. Haunting […] lies precisely in its refusal to stop. Alien (to settlers) and generative for (ghosts), this refusal to stop is its own form of resolving. For ghosts, the haunting is the resolving, it is not what needs to be resolved. […] Haunting is the cost of subjugation. It is the price paid for violence, for genocide […] Erasure and defacement concoct ghosts; I don’t want to haunt you, but I will. (Tuck and Ree 2013, 642–643).

Some of our contributors find postcolonial communities grappling with the intricacies of fragmented colonial memories and/or trauma (O’Riley 2007). Others are interested in financial coloniality as a racial ordering system ‘classifying, ordering, creating and destroying people, labour power, land, environment and capital’ (Tilley and Shilliam 2018, 537). All our contributors express standard postcolonial concerns with ‘modern forms of dispossession, exploitation, repression, and their concrete impacts’ on people (Gordon 1997/2008, xv). When read together, we hope that readers will be able to see the affective nature of the spectres of financial capital, accumulated through time.

References

Arthur, C. J. 2001. “The Spectral Ontology of Value.” Radical Philosophy 107 (May/June): 32–42.

Baucom, I. 2005. Specters of the Atlantic: Finance Capital, Slavery, and Philosophy of History. Durham, NC: Duke University Press.

Bhandar, B. 2019. Colonial Lives of Property: Law, Land and Racial Regimes of Ownership. Durham, NC: Duke University Press.

Bhattacharyya, G. 2018. Rethinking Racial Capitalism: Questions of Reproduction and Survival. London: Rowman & Littlefield.

Blaney, D. L., and N. Inayatullah. 2009. Savage Economics: Wealth, Poverty and the Temporal Walls of Capitalism. New York: Routledge.

Bourne, C., P. Gilbert, M. Haiven, and J. Montgomerie, eds. 2018. Colonial extractives, imperial insolvencies, extractive nostalgias. Discover Society. September 4, https://maxhaiven.com/2018/09/05/discover-society-section/.

Burden-Stelly, C. 2019. “Black Studies in the Westernized University. The Interdisciplines and the Elision of Political Economy.” In Unsettling Eurocentrism in the Westernized University, edited by J. Cupples, and R. Grosfoguel, 73–86. Abingdon, Oxon: Routledge.

Cain, R., and J. Montgomerie. 2019. “The Zombie Economy and the Aesthetics of Austerity.” Angles: New Perspectives on the Anglophone World, 8. https://journals.openedition.org/angles/582.

Cameron, A. 2015. “Where has all the Money Gone? Materiality, Mobility, and Nothingness.” Finance and Society 1 (1): 7–19. Crossref.

Cariou, W. 2006. “Haunted Prairie: Aboriginal ‘Ghosts’ and the Specters of Settlement.” University of Toronto Quarterly 75 (2): 727–734. ISI.

Chakravartty, P., and D. F. da Silva. 2012. “Accumulation, Dispossession, and Debt: The Racial Logic of Global Capitalism—an Introduction.” American Quarterly 64 (3): 361–385. Crossref. ISI.

Cipolla, C. 1956. Money, Prices, and Civilization in the Mediterranean World, Fifth to Seventeenth Century. Princeton: Princeton University Press.

Cooper, M., and L. McFall. 2017. “Ten Years After: It’s the Economy and Culture, Stupid!.” Journal of Cultural Economy 10 (1): 1–7. Crossref. ISI.

Cordes, A. 2022. “Storying Indigenous Cryptocurrency: Reckoning with the Ghosts of US Settler Colonialism in the Cultural Economy.” Journal of Cultural Economy. Crossref. PubMed. ISI.

Couldry, N., and U. A. Mejias. 2019. “Data Colonialism: Rethinking big Data’s Relation to the Contemporary Subject.” Television & New Media 20 (4): 336–349. Crossref. ISI.

Crosthwaite, P., P. Knight, and N. Marsh. 2014. Show me the Money: The Image of Finance, 1700 to the Present. Manchester, UK: Manchester University Press.

da Silva, D. F. 2022. Unpayable Debt. On the Antipolitical, Volume 1. London: Sternberg Press.

Dattani, K. 2023. “The Ghosts in the Database: Biometrics, Fintech and the Corporate-State in India.” Journal of Cultural Economy. Crossref. ISI.

De Cock, C., and D. Nyberg. 2014. “The Possibility of Critique Under a Financialized Capitalism: The Case of Private Equity in the United Kingdom.” Organization 23 (4): 465–484. Crossref. ISI.

de Goede, M., and C. Westermeier. 2022. “Infrastructural Geopolitics.” International Studies Quarterly 66 (3): sqac033. Crossref. ISI.

del Pilar Blanco, M., and E. Peeren, eds. 2013. The Spectralities Reader: Ghosts and Haunting in Contemporary Cultural Theory. New York/London: Bloomsbury.

Delaplace, G. 2012. “Parasitic Chinese, Vengeful Russians: Ghosts, Strangers and Reciprocity in Mongolia.” Journal of the Royal Anthropological Institute 18 (s1): S131–S144. Crossref.

Derrida, J. 1994. Specters of Marx: The State of the Debt, the Work of Mourning, and the New International. New York: Routledge.

du Gay, P., M. Pryke, and T. Bennett. 2022. “Cultural Revolutions: Interview with Paul du Gay and Michael Pryke.” Journal of Cultural Economy. Crossref. PubMed. ISI.

Ertürk, I. 2016. “Shadow Banking: A Story of the Doppelgänger (the Double) in Science of Finance.” Journal of Cultural Economy 10 (4): 377–392. Crossref. ISI.

Fisher, M. 2013. “How to Kill a Zombie: Strategizing the End of Neoliberalism.” Open Democracy, July 18. https://www.opendemocracy.net/en/how-to-kill-zombie-strategizing-end-of-neoliberalism/.

Fisher, M. 2014. Ghosts of my Life: Writings on Depression, Hauntology and Lost Futures. Winchester, UK: Zero Books.

Gilbert, P. 2020. “Speculating on Sovereignty: Money Mining and Corporate Foreign Policy at the Extractive Industry Frontier.” Economy and Society. 49: 16–44. Crossref. ISI.

Gilbert, P., C. Bourne, M. Haiven, and J. Montgomerie. 2023. The Entangled Legacies of Empire: Race, Finance and Inequality. Manchester, UK: Manchester University Press. Crossref.

Gilman-Opalsky, Richard. 2016. Specters of Revolt. London: Repeater.

Giroux, H. 2010. Zombie Politics and Culture in the age of Casino Capitalism. New York: Peter Lang.

Gordon, A. 1997/2008. Ghostly Matters: Haunting and the Sociological Imagination. Minneapolis, MN: University of Minnesota Press.

Gordon, A. 2011. “Some Thoughts on Haunting and Futurity.” Borderlands 10 (2): 1–21.

Gordon, A. 2013. “Her Face, his Hand.” In The Spectralities Reader: Ghosts and Haunting in Contemporary Cultural Theory, edited by M. P. del Pilar Blanco, and E. Peeren, 103–130. New York: Bloomsbury Press.

Goswami, M. 2018. “Crisis Economics: Keynes and the end of Empire.” Constellations (oxford, England) 25 (1): 18–34. Crossref.

Guerisoli, E., and S. Mandirola. 2022. “New Financializations, old Displacements: Neo-Extractivism, ‘Whitening’, and Consumption in Latin America.” Journal of Cultural Economy 1–18. Crossref. ISI.

Guermond, V., and N. S. Sylla. 2018. “When Monetary Coloniality Meets 21st Century Finance: Development in the Franc Zone.” Discover Society, September 4. https://discoversociety.org/2018/09/04/when-monetary-coloniality-meets-21st-century-finance-development-in-the-franc-zone/.

Haiven, M. 2020. Revenge Capitalism: The Ghosts of Empire, the Demons of Capital, and the Settling of Unpayable Debts. London: Pluto Press. Crossref.

Haiven, M. 2022. Palm oil: The Grease of Empire. London: Pluto Press. Crossref.

Haiven, M.. 2023. “For the Refusal of Unpayable Debts: An Artists’ Roundtable with Dele Adeyemo, Ahmed Isamaldin, Bahar Noorizadeh, and Gary Zhexi Zhang.” Journal of Cultural Economy. Crossref. ISI.

Hall, C. 2018. “Doing Reparatory History: Bringing ‘Race’ and Slavery Home.” Race & Class 60 (1): 3–21. Crossref. ISI.

Hall, C., K. McClelland, N. Draper, K. Donington, and R. Lang. 2014. Legacies of British Slave-Ownership: Colonial Slavery and the Formation of Victorian Britain. Cambridge: Cambridge University Press. Crossref.

Hardin, C. 2017. “The Politics of Finance: Cultural Economy, Cultural Studies and the Road Ahead.” Journal of Cultural Economy 10 (4): 325–338. Crossref. ISI.

Harman, C. 2010. Zombie Capitalism: Global Crisis and the Relevance of Marx. Chicago, IL: Haymarket Books.

Hudson, P. J. 2017. Bankers and Empire: How Wall Street Colonized the Caribbean. Chicago.: The University of Chicago Press. Crossref.

Just, S. N. 2019. “Finance, Possessed: Sighting Supernatural Figurations in Critical Accounts of the Financial Crisis.” Ephemera: Theory & Politics in Organization 19 (1): 129–151.

Kish, Z., and J. Leroy. 2015. “Bonded Life: Technologies of Racial Finance from Slave Insurance to Philanthrocapital.” Cultural Studies 29 (5-6): 630–651. Crossref. ISI.

Langley, P., and D. Rodima-Taylor. 2022. “FinTech in Africa: An Editorial Introduction.” Journal of Cultural Economy 15 (4): 387–400. Crossref. ISI.

Lapavitsas, C. 2013. Profit Without Producing: How Finance Exploits us all. London: Verso Books.

LiPuma, E., and B. Lee. 2004. Financial Derivatives and the Globalization of Risk. Durham, NC: Duke University Press.

Malik, S. 2022. “Reflections on Representing Black Britain.” Journal of Cultural Economy. 1–9. Crossref. ISI.

Marx, K. 1867/1976. Capital: A Critique of Political Economy, Volume 1. New York: Random House.

McNally, D. 2011. Monsters of the Market: Zombies, Vampires and Global Capitalism. Leiden, The Netherlands: Brill. Crossref.

Montgomerie, J. 2016. “Beyond the Zombie Economy.” Open Democracy. https://www.opendemocracy.net/en/opendemocracyuk/beyond-zombie-economy/.

Montgomerie, J., and R. Cain. 2019. “Resisting the Zombie Economy: Finding the Right Metaphor for the Crisis.” In Neoliberalism in Context: Governance, Subjectivity and Knowledge, edited by S. Dawes, and M. Lenormand, 39–60. Abingdon: Routledge.

Mottley, M. 2022. Mia Mottley, Prime minister of Barbados at the Opening of the #COP27 World Leaders Summit, UN Climate Change, https://www.youtube.com/watch?v = 5J0egwAfO0w.

Negri, A. 1999/2008. “The Specter’s Smile.” In Ghostly Demarcations: A Symposium on Jacques Derrida’s Specters of Marx, edited by M. Sprinker, 5–16. London, UK: Verso.

Nelms, T. C. 2012. “The Zombie Bank and the Magic of Finance, or: How to Write a History of Crisis.” Journal of Cultural Economy 5 (2): 231–246. Crossref.

O’Riley, M. F. 2007. “Postcolonial Haunting: Anxiety, Affect, and the Situated Encounter.” Postcolonial Text 3 (4): 1–15.

Park, K. 2016. “Money, Mortgages, and the Conquest of America: Money, Mortgages, and the Conquest of America.” Law & Social Inquiry 41 (04): 1006–1035. Crossref.

Patnaik, U. 2017. “Mr Keynes and the Forgotten Holocaust in Bengal, 1943–44: Or, the Macroeconomics of Extreme Demand Compression.” Studies in People’s History 4 (2): 197–210. Crossref.

Peck, J. 2010. “Zombie Neoliberalism and the Ambidextrous State.” Theoretical Criminology 14 (1): 104–110. Crossref. ISI.

Peeren, E. 2014. The Spectral Metaphor: Living Ghosts and the Agency of Invisibility. Basingstoke: Palgrave Macmillan. Crossref.

Safieddine, H. 2019. Banking on the State: The Financial Foundations of Lebanon. Stanford, CA: Stanford University Press. Crossref.

Saleh-Hanna, V. 2015. “Black Feminist Hauntology: Rememory the Ghosts of Abolition?” Penal Field/Champ Penal, XII. Crossref.

Samman, A. 2015. “Introduction: Money’s Other Worlds.” Finance and Society 1 (2): 23–26. Crossref.

Selfin, Y., and B. Nimmo. 2019. “Zombies in Our Midst.” KPMG Economic Insights, May.

Shilliam, R. 2021. Decolonizing Politics: An Introduction. Cambridge UK: Polity Press.

Siggins, M. 1991. Revenge of the Land: A Century of Greed, Tragedy and Murder on a Saskatchewan Farm. Toronto: McClelland & Stewart.

Sismondo, S. 2018. Ghost-managed Medicine: Big Pharma’s Invisible Hands. Manchester UK: Mattering Press. Crossref.

Styve, M. D. 2019. From Marikana to London: The Anti-Blackness of Mining Finance. Thesis for the Degree of Philosophiae Doctor. Bergen: University of Bergen.

Styve, M. D., and P. R. Gilbert. 2023. “The Hole in the Ground That Cannot be Moved’: Political Risk as a Racial Vernacular of Extractive Industry Development.” The Extractive Industries and Society 13: 101100. Crossref.

Taylor, K. 2019. Race for Profit: How Banks and the Real Estate Industry Undermined Black Homeownership. Chapel Hill, NC: University of North Carolina Press. Crossref.

Tilley, L., and R. Shilliam. 2018. “Raced Markets: An Introduction.” New Political Economy 23 (5): 534–543. Crossref. ISI.

Tonda, J. 2005/2011. The Modern Sovereign: The Body Power in Central Africa. Calcutta: Seagull Books.

Toussaint, É. 2019. The Debt System: A History of Sovereign Debts and Their Repudiation. Chicago, IL: Haymarket.

Tuck, E., and C. Ree. 2013. “A Glossary of Haunting.” In Handbook of Autoethnography, edited by S. H. Jones, T. E. Adams, and C. Ellis, 639–658. Walnut Creek, CA: Left Coast Press In.

Vogl, J. 2015. The Specter of Capital. Stanford, CA: Stanford University Press.

Wang, J. 2018. Carceral Capitalism. South Pasadena, CA: Semiotext(e).

Weinstock, J. A. 2013. “Introduction: The Spectral Turn.” In Spectralities Reader: Ghosts and Haunting in Contemporary Cultural Theory, edited by M. del Pilar Blanco, and E. Peeren, 62–62. New York/London: Bloomsbury.